A boost for Champagne and Rhone Valley

- Wines like Mouton Rothschild and Chateau Latour saw several vintages achieve good solid increase.

- Chateau Latour released their vintage 2012 in May at a price point of 20% lower than the 2011. Taking a cautious step back into releasing older vintages.

- The En primeur campaign was released yesterday with an online experience unlike any other for the first time in history. Wines were shipped out to critics homes for tasting and there were no usual trips to Bordeaux for tasting.

- Usually during en primeur month, the secondary market takes a breather, but in reality it is not what we are experiencing.

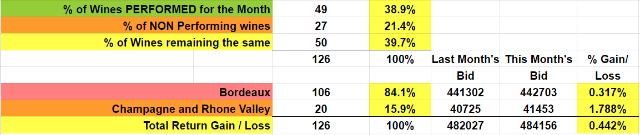

- 39% of wines this month showed a positive increase.

If you are a buyer, This week we started highlighting wines priced below market value in RED on the latest offers page of our website. Prices discounted between 5 and 15%.

Simply copy and paste the wine name into wine searcher to check the price is well below market value. Its really easy, give it a try if you’re looking for a bargain and immediate profits. These deals are offered by other Investors who need urgent liquidity and lowered the price to attract a quick sale. Latest Offers Click Here

James Pala

InvestIntoWine.com

– 84.1% of our portfolio is Bordeaux while 15.9% is Champagne and Rhone Valley.

– The overall change for ALL the wines valued this month was +0.442%

Scroll down for the winners and losers for May versus June.

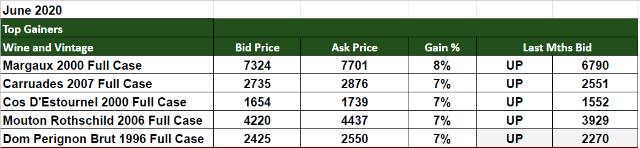

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices, are reflected in your online portfolio every month.

Please log on to our website investintowine.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

To view our terms and conditions click here

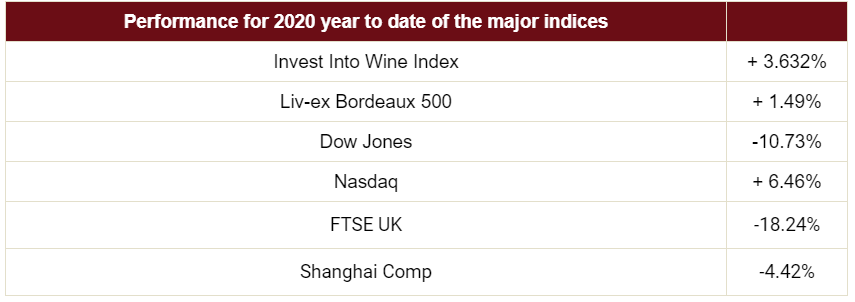

Stock Markets, the Economy & Who’s going out for dinner?

The stock markets continue to rally, the Nasdaq is reaching for an all time high. As the Federal reserve has promised to bail out companies, the money printing factory is in full force. As the Trump train is determined to win the election, they need the stock market to remain high. It could come crashing down anytime but its more likely to happen after the election. Companies are holding off share buy backs which would not bode well in the public eye if they are seen to be pumping their stock price during a pandemic.

Things could get worse for the F&B industry, as restaurants need to rethink how they will attract customers to dine in. The social distancing measures that customers will expect could be a financial burden. Creating more space will mean less customers, or quicker turnover of tables to allow the flow of customers. This can be tricky to manage if you have a small space, especially in Europe where restaurants are often smaller and quaint.