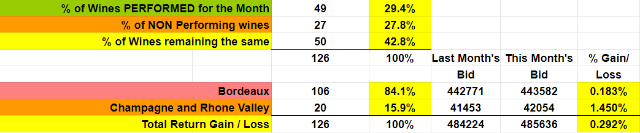

Champagne and Rhone Valley Beats Bordeaux

- The number of wines that did perform and did not perform was almost equal. The performing wines taking the lead slightly over the losers.

- Buying wine below market prices is very achievable, which means like other industries mixed with roaring online sales and dull sales in the F&B industry. One obviously compensating the other.

- The En primeur campaign turned out successful, with prices being offered much lower than previous vintages.

- 30% of wines this month showed a positive increase.

James Pala

– 84.1% of our portfolio is Bordeaux while 15.9% is Champagne and Rhone Valley.

– The overall change for ALL the wines valued this month was +0.292%

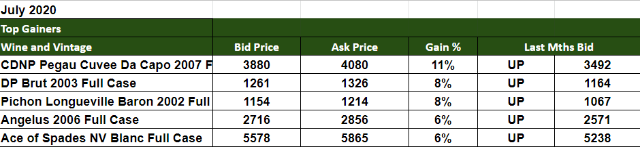

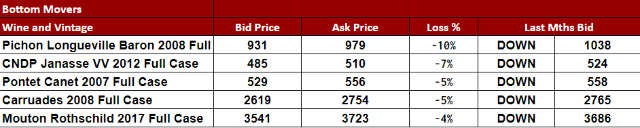

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices, are reflected in your online portfolio every month.

Please log on to our website investintowine.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

To view our terms and conditions click here

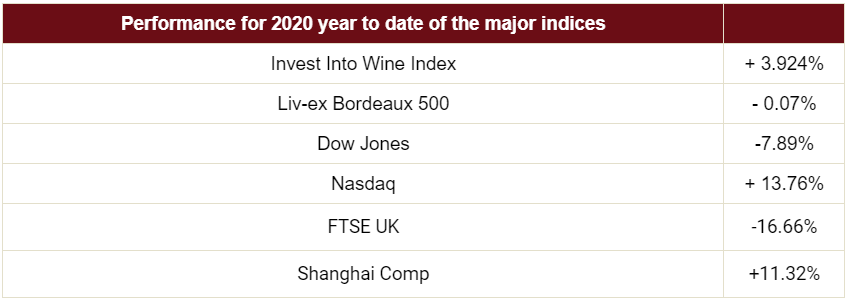

Markets and The Economy

There is much concern that the stock markets are again becoming over heated and heading for a big downturn. As election grows closer, the Trump campaign needs a strong stock market to get re-elected.

As we watch the world trying to recover, could an opportunity lie ahead?

Everyone is thinking the worst will happen

The European stock markets like the FTSE are down as much as 17% based on the last 12 months. Investors could see this as an opportunity, since Europe is now opening back again and better control of Covid 19.

Several states in the USA have increasing Covid 19 numbers. It looks like the USA is heading for herd immunity. The pain of closing down again is too great for the economy to handle financially. The handouts are crippling countries reserves.

Millions of people across the globe are out of work, yet they have a bigger incentive to stay off work with the government subsidies they are receiving.

The U.S election is coming in November. Changes in the U.S economy have a big impact on the rest of the world.

If Trump wins, – His bullish strategy, expect stocks to balloon until at some point collapse. There will be big winners but even bigger losers. It’s not worth taking bets on the financial markets and safer to stay clear from the chance of destroying one’s finances than the chance of making a quick buck.

– Wine will continue to grow at its usual steady pace. It will always outperform the indices over time.

If Biden wins, Investors will run for the hills. Markets will collapse. Confidence will be down.

– Wine investment will boom.