Wine & Spirits Investment Report Oct 2020

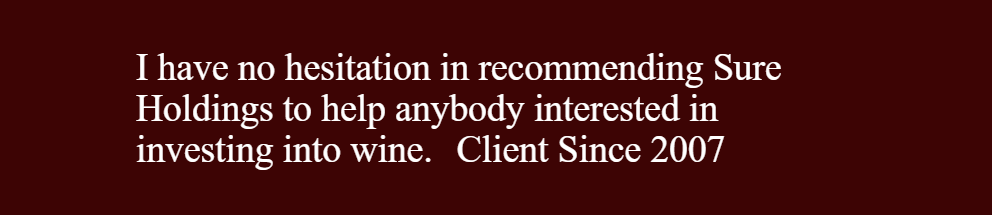

Invest Into Wine – Track Record summary for 2016. Full track record dating back to 2005 with every wine invested can be viewed by clicking here.

October Wine Prices are UP!

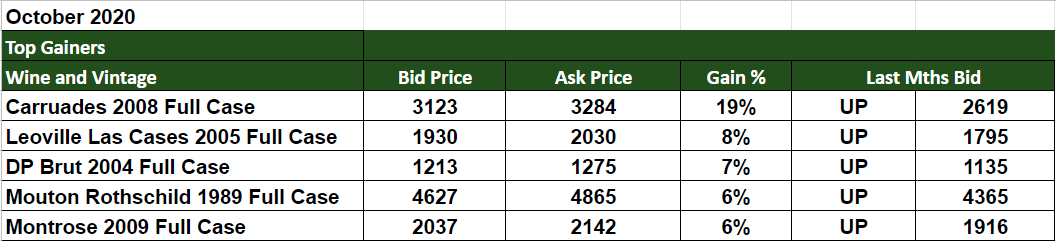

Chateau Leoville Las Cases 2005 shot up 8% this month followed by Dom Perignon Champagne 2004 increasing 7%.

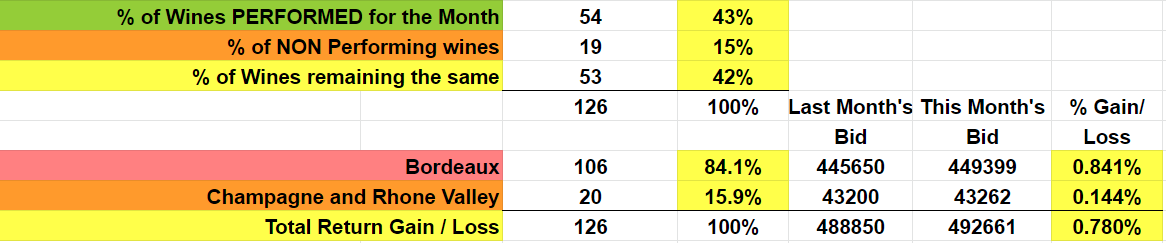

There was a marked improvement in the wine market overall, with 43% of wines showing an increase versus only 15% with a decrease. 42% remained the same.

The Invest Into Wine Index results were positive this month with a 0.7% gain overall.

A range of vintages of Bordeaux wines, in particular Lafite Rothschild, Margaux and Mouton Rothschild performed very well for the 30 day period.

We launched our first whisky recommendations last week!

The 4 recommendations that we emailed to you were gone within 24 hours of sending the emails out.

It was an overwhelming response! We apologise to those who missed out.

We are working hard to find more opportunities like these.

Stay tuned and reply fast if you are interested in the next parcel.

We are testing the market by selling 1 bottle closer to the price other whisky merchants are selling for.

Two of the whisky we recommended were 60% cheaper than the absolute lowest price in the market. We will put one for sale at 50% higher than the price we recommended to you as a test case. (Still 10% cheaper than the lowest price we could find).

Stay tuned to hear how it went.

Valuing whisky is more difficult than wine, because it is even more rare. Often whisky have production levels at less than 500 bottles, with only 2 or 3 merchants selling them at any one time, it does not present a large amount of data like wine.

Whisky is mainly a collector’s market. A collector will buy and consume. Because whisky is easier to keep at home than wine, collectors tend to keep them at home rather than in a professional bonded warehouse like we keep all our wines and spirits.

The reason we are able to obtain these rare whisky at such low prices, is because we have a strong network in the wine & spirits industry from the past 20 years.

It was very easy to expand into whisky, we know who are the cheapest merchants who work on low margins like us,

AND

which distributors will sell them for reasonable prices because they like to turn stock over quickly…

Rather than merchants who work on very high margins and are happy to sit on the stock until a collector comes along with a high offer to buy.

Wine and other hard assets are becoming flavour of the quarter…

Restaurants and other F&B outlets are starting to open up around the world, despite the pandemic still in play.

This should boost the wine & spirits market as more people start to socialise, however different parts of the world are facing the pandemic at different stages.

- There will be more about the effect of the pandemic on the world’s economy in part 3 of this report.

Nevertheless, people will continue to consume alcohol, when times are good, there’s a bottle opening to celebrate and when times are bad, we again find a bottle in our hands..

Why is the wine & spirits market on the rise?

This can be contributed to uncertainty around the world’s economy. Its important to remain optimistic about the economy opening back up and rebounding at record levels. But there is no specific timeframe when the world will overcome Covid 19.

When will a vaccine be out? Will it be accepted among the masses? There has been a lot of controversy and skepticism towards the safety of a vaccine due to its urgency. And how long will it take to adopt?

This uncertainty is one of the main reasons wine, spirits, gold etc are going up right now.

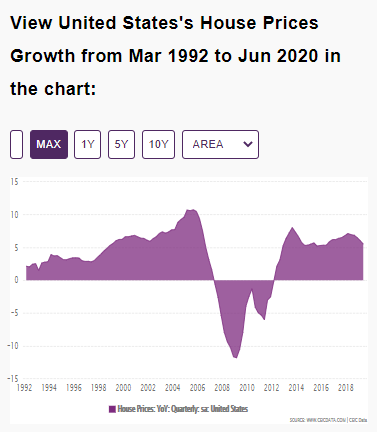

The stock market looks to be at a tipping point, the real estate market in USA has been hot for the last 5 months, but it’s also starting to reach a peak and it’s likely to come down in the New Year if job losses remain at such high levels.

It is hard to find recent data on the global unemployment rate, the USA was at 15% unemployment in April 2020. The global unemployment rate I would take a guess at 18% given the state of many countries under a more severe lockdown.

This uncertainty is why investors turn to hard assets, because they are the most stable investments that always hold their values in rough times.

Will the wine & spirits market continue to go up?

It is hard to predict a rally based on one month of data, it would be more prudent to make that call after 3 months of continuous growth over 1% each month.

This is why it is important to be invested in a potential rally before it happens. Because often it is then too late and prices are already escalating.

Especially in the rare wine and spirits market where availability of stock is limited.

If you are selling wine, buyers are looking for bargains. Remain low enough to entice a buyer, we are not in a rally just yet.

What wines would be best to buy right now? Play it safe, stay in first growth Bordeaux wines, like Mouton, Lafite, Margaux, Petrus or Haut Brion etc. Wines that you know well, that are household names.

These wines always remain in demand and have a good track record of doing well when a rally starts.

Look out for an email that is sent every Monday and Thursday from WineTrade@InvestIntoWine.com

For The Latest Available Offers Click Here

Stay safe in life and investments!

Kind regards

James Pala

Europe’s No 1 Wine Investment Analyst

Founder InvestIntoWine.com

|

Performance for 2020 ‘Year To Date’

|

|

|---|---|

|

Invest Into Wine Index

|

+ 5.047%

|

|

Liv-ex Bordeaux 500

|

+ 2.52%

|

|

Dow Jones

|

– 0.40%

|

|

Nasdaq Composite

|

+ 27.29%

|

|

UK FTSE

|

– 20.74%

|

|

Shanghai Comp

|

+ 5.51%

|

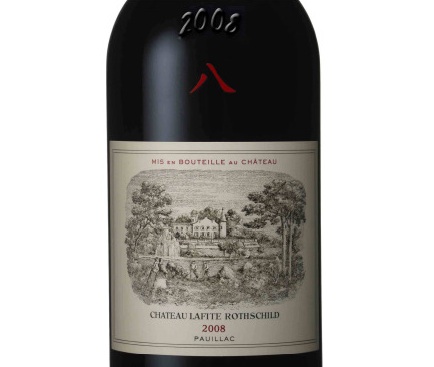

Invest Into Wine – Track Record dating back to 2013-2016. Full track record with every wine invested can be viewed by clicking here.

Important Update When Checking Your Wine Portfolio

We maintain our bid prices at 1% below market value, as we increase it slowly back up to market price. We will monitor performance and activity in the market closely over the next 1-2 months.

– 42.9% of the wines valued showed a positive return, while 15.1% showed a negative return and 42.1% remained the same.

– 84.1% of our portfolio is Bordeaux while 15.9% is Champagne and Rhone Valley.

– The overall change for ALL the wines valued this month was +0.702%

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices, are reflected in your online portfolio every month.

Please log on to our website investintowine.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

To view our terms and conditions click here

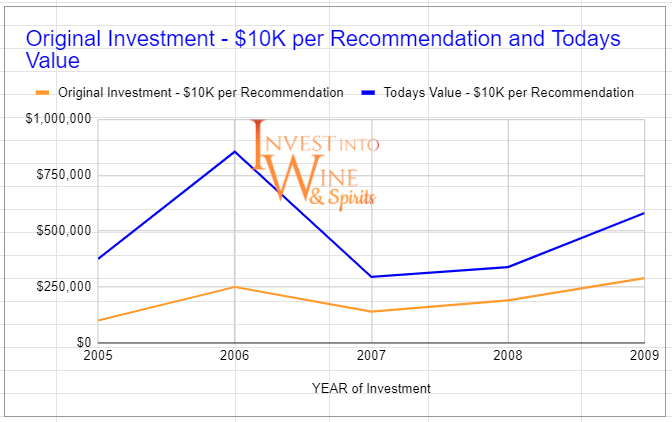

Invest Into Wine Track Record – Based on investment of $10K per recommendation and today’s value. All wines recommended between 2005 and 2009.

Full track record with every wine invested can be viewed by clicking here.

Markets and The Economy

Opening up the Economy with the Pandemic

One of the biggest challenges stifling the Economy is the lack of travel.

Airlines are hit badly which has a knock on effect to the fuel industry and impacts businesses from conducting business travel. Resulting in fewer expansion plans and decision making where physical meetings are necessary to investigate or analyze projects.

The Taxi industry, Uber and Grab car are affected as less people move around (Previously a way for people to earn additional income). Those who needed it because they were out of work or needed more income to support their jobs.

More people than usual stay at home and don’t need to drive because of the shift to working from home. People think twice about taking an Uber or taxi unless absolutely necessary because of covid concerns. A further reduction in spending.

This has resulted in homes being sold outside of cities in suburban areas, home projects and home furniture sales have improved. More jobs are created through online business with companies like Amazon and google.

Can the positives support the negatives in the world’s economy?

Living with the Pandemic

Life is very different for many people compared to pre pandemic.

Economies like the USA and China continue to remain alive because of the size of their domestic business. Countries that rely heavily on tourism like Thailand, Mexico and Spain are hit hard.

The adoption of AirBnb and VRBO in real estate over the last 5 years allowing more home owners to rent out their properties to travellers has been impacted. This was a growing and substantial part of the real estate market, which has almost disappeared completely in the last six months in many countries. Some rental markets have benefited where there has been migration out of big cities.

Hotels have been closed completely in many countries for the last six months with no set dates for reopening. An effort to maintain cash flows with lower overheads just to remain in business.

Coronavirus – A visual guide to the economic impact

Despite job losses in the economy, there is a sense of well being across the world as I talk with clients in different continents.

The lack of urgency from working at home, not having to travel constantly or drive several hours each day to reach work is a huge positive change for many people worldwide. Allowing people to spend more time with their families and enjoy healthier meals with their loved ones. As opposed to grabbing a quick fast food meal while on the run to another meeting.

The health benefits of being in lockdown have been very positive for a lot of people. Hopefully this will continue post pandemic.

How quickly will the economy bounce back with a vaccine?

A vaccine is a solution but it’s not the magic fix that’s going to immediately get the economy in full force. It could take 6-12 months for vaccines to be distributed and applied worldwide.

The problem is acceptance, as internet hysteria and the efficacy of new vaccines raise concerns which make them less appealing for public acceptance.

What’s needed is jobs and confidence for people to move and travel.

There is a strong positive attitude in the USA to get back to work, travel again and go on holiday. But this same attitude is not shared globally. As the rest of the world does not see U.S politics the same way that an American sees it. It won’t blow over after the U.S election.

The reality is it will take several years for the economy to recover. The impact this pandemic has had on small businesses is bad. Depleted cash flows make it harder for businesses to not only thrive but consider expanding.

Amazon, Google continue to thrive worldwide

Google, Amazon and some companies have done tremendously well from the pandemic. Will their success be enough of a gap to fill the economy?

The U.S property market is heading for a correction in 2021, which could impact the stock market. The rise in property sales and prices has been a rapid acceleration which is likely to slow down as mortgage rates increase in 2021.

The rally in the last six months in real estate has been misjudged by many as an opportunity, while interest rates are low. Commercial real estate took a hit due to people moving out of cities to stay in areas that are less populated, with a preference to working from home.

Governments continue to print money and ask banks to continue with loan repayment schemes. This could ease homeowners in the short term.

The real estate market last crashed in 2008, it has been rising since 2012. The 10 year drop in the property cycle is likely to come between 2021 and 2022.

Living with the Pandemic

Life is very different for many people compared to pre pandemic.

Economies like the USA and China continue to remain alive because of the size of their domestic business. Countries that rely heavily on tourism like Thailand, Mexico and Spain are hit hard.

The adoption of AirBnb and VRBO in real estate over the last 5 years allowing more home owners to rent out their properties to travellers has been impacted. This was a growing and substantial part of the real estate market, which has almost disappeared completely in the last six months in many countries. Some rental markets have benefited where there has been migration out of big cities.

Hotels have been closed completely in many countries for the last six months with no set dates for reopening. An effort to maintain cash flows with lower overheads just to remain in business.

Coronavirus – A visual guide to the economic impact

Despite job losses in the economy, there is a silver lining.

There is a sense of well being across the world as I talk with clients in different continents.

The lack of urgency from working at home, not having to travel constantly or drive several hours each day to reach work is a huge positive change for many people worldwide. Allowing people to spend more time with their families and enjoy healthier meals with their loved ones. As opposed to grabbing a quick fast food meal while on the run to another meeting.

The health benefits of being in lockdown have been very positive for a lot of people. Hopefully this will continue post pandemic.