Wine & Spirits Investment Report November 2020

This investment report is sent in 3 parts. Access full copies of the reports HERE (If you don’t want to wait)

Did you know our website has changed recently?

Another Increase for the Wine Market in November !

Whisky recommendations sell out within 2 hours….

- While conducting valuations on whisky, our research team find that the data is very sparse. Mainly due to the lack of bottles available in the marketplace.

- We are buying and recommending whisky’s that are priced between $1000 and $5000 USD per bottle. This has been where our research & negotiation team have focused their efforts.

- It is an easy entry point for our investor base. Allowing more investors to participate.

- The same Suppliers we have bought and sold from in the last 20 years are able to offer rare whisky bottles that are way below what the auction prices are fetching.

- Knowing which merchants sell on margins of 5% is crucial to finding whisky below an auction price.

- More than 70% of wine and spirits merchants work on profit margins of 10-30%, this can kill your return on investment.

Wine prices increasing, despite a global pandemic

If you are selling wine, buyers are looking for bargains. Be 2% or more lower than the bid price to entice a buyer, we are not in a full blown rally just yet.

What wines would be best to buy right now?

Play it safe, stay in first growth Bordeaux wines, like Mouton, Lafite, Margaux, Petrus or Haut Brion etc. Famous wines that you know well.

These wines are in demand and have a good track record of doing better, first when a rally starts.

Look out for an email that is sent every Monday and Thursday from WineTrade@SureHoldings.com

For The Latest Available Offers Click Here

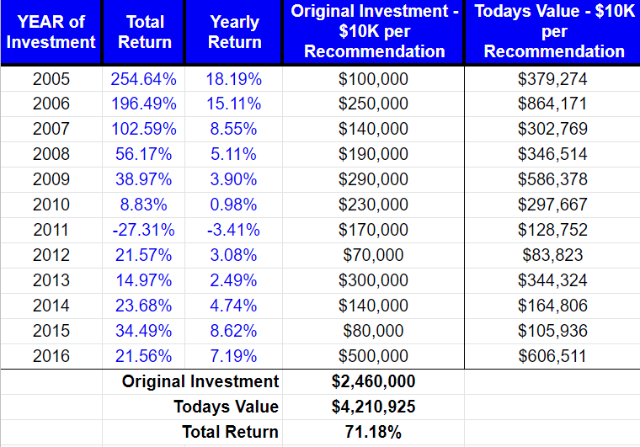

The major indices table below, compares the Invest Into Wine Index with the London Vintners Exchange Index and some of the world’s stock markets.

Happy Hunting!

Kind regards

James Pala

Europe’s No 1 Wine Investment Analyst

Founder SureHoldings.com

Important Update When Checking Your Wine Portfolio

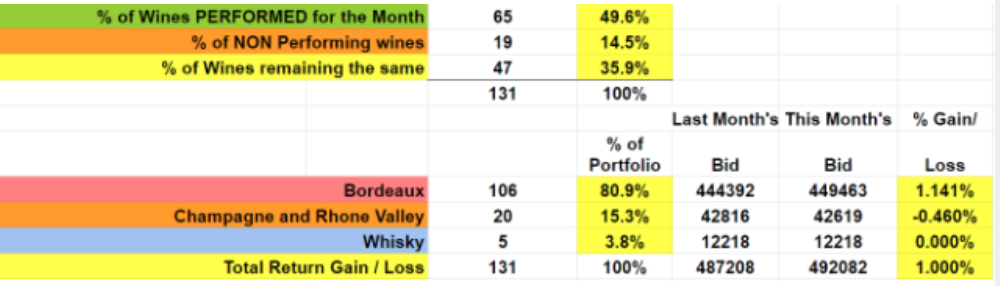

– 80.9% of our portfolio is Bordeaux while 15.3% is Champagne and Rhone Valley and our new addition of Whisky investments make up 3.8%

– The overall change for ALL the wines valued this month was UP +1.001%

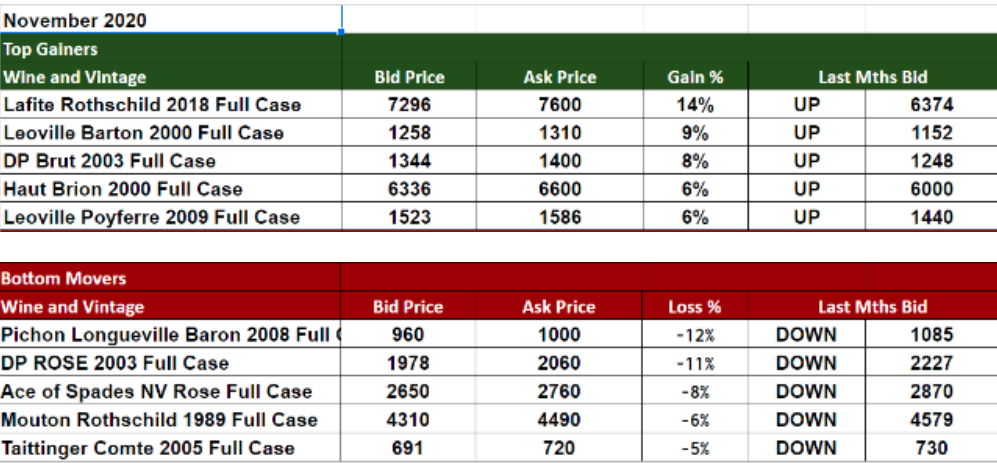

Scroll down for the winners and losers for October versus November.

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices, are reflected in your online portfolio every month.

Please log on to our website SureHoldings.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

To view our terms and conditions click here

Markets and The Economy

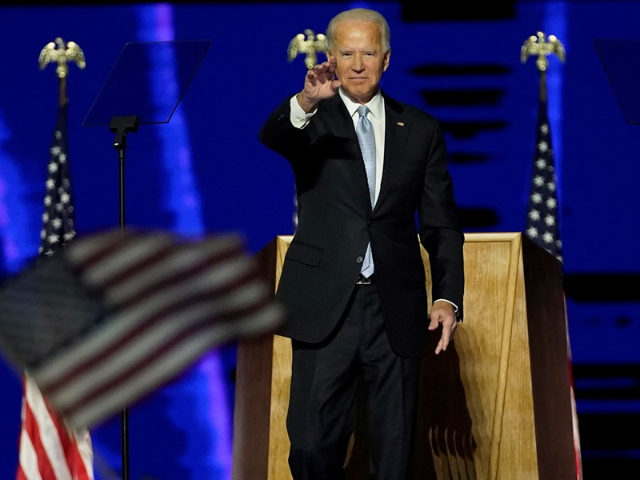

The USA has a new President, how will it affect markets?

Biden’s election policies according to joebiden.com are listed with the highest priority on fighting the pandemic, with statements of listen to the science and make public decisions based on health professionals. It’s likely that pharmaceutical and the medical industries will benefit greatly. Biden has already nominated a coronavirus task force in his transition team.

Dow Jones almost reaches 30,000 points

The U.S Stock market rallied on Monday 9th November 2020 and the Dow Jones almost reached 30,000 for a brief moment in trading, reaching a high of 29,896 points.

This short term rally could push the markets into a correction or the market could power through and hit another record high. At the current levels, both Nasdaq and the Dow are at all time highs. When a market is hitting all time highs without any real reason, it is safer to assume that markets will fall as opposed to rally. After all, where is the new money coming from?

The Dow Jones as of Monday’s close was 29,158.

Pfizer announced a vaccine that is 90% effective in 1st analysis

Pfizer could apply for an urgent FDA approval but it is still too early to expect a vaccine within the next two months.