Wine & Spirits Investment Report January 2021

Have a question?

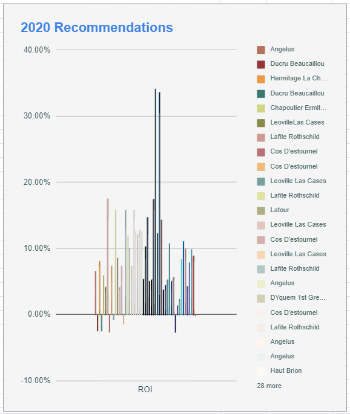

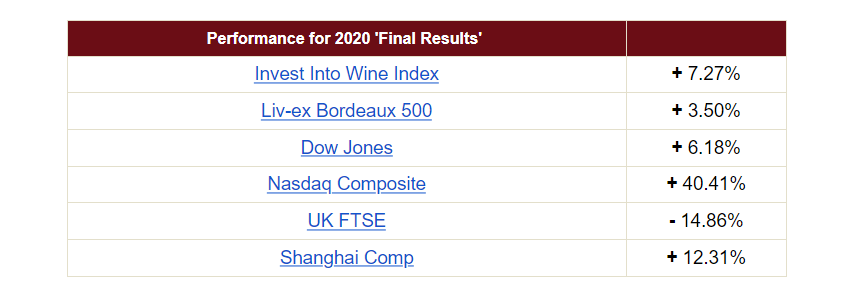

2020 recommendations achieved 11.2% growth!

Keeping margins lower than ever!

With that in mind, we must stay true to our word and keep margins low so that you can see profits earlier and maximize return on investment in a shorter period of time.

This partnership we have forged with our clients and winemakers is becoming quite a success story.

We have some exciting news to share with you, but we can not release this news just yet, because other wine companies will copy it.

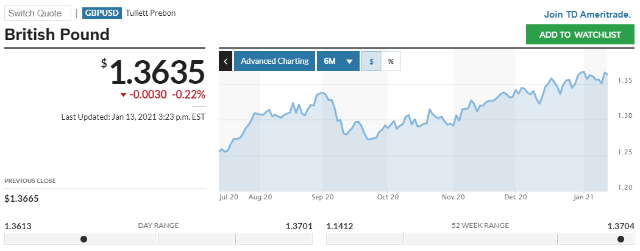

UK and EU finally agree on a deal

- Years ago, wine from the secondary market was easier to sell via auction from a collector’s cellar.

- Over the last 20 years, the market has matured and with the emergence of fine wine trading platforms, it has become more popular to sell wines via these platforms, brokers and merchants worldwide.

- Whisky is a market that is new to investors, with only an emergence of investor presence in recent years.

- Whisky is similar to the wine auction market, many years ago.

- Buyers can find sellers of specific fine and rare whisky with the added security of an auction house checking the authenticity of the product.

James Pala

Fully managing your portfolio is part of our standard service

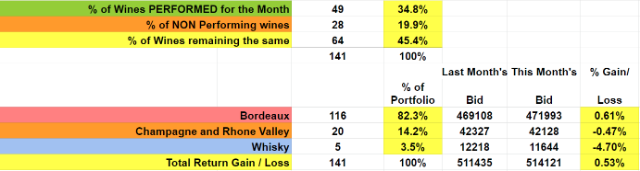

– 82.3% of our portfolio is Bordeaux while 14.2% is Champagne and Rhone Valley and our new addition of Whisky investments make up 3.5%

– The overall change for ALL the wines valued this month was UP +0.53%

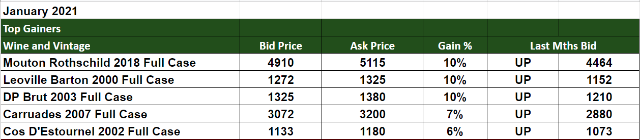

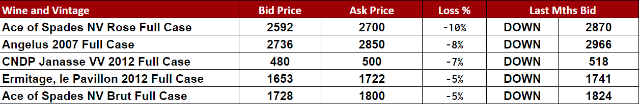

Scroll down for the winners and losers for December versus January.

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices, are reflected in your online portfolio every month.

Please log on to our website SureHoldings.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

To view our terms and conditions click here

Markets & Economy |

|

DXY – U.S. Dollar Index 6 Mth Chart

– a measure of the currency against six major rivals

|

Bitcoin takes a hit, will it and how fast can it rebound?

On Friday, Bitcoin reached its record high of $41,500 per bitcoin. A growth surge of 260% in just 3 months!

Is the big Bitcoin rally finally over? Or is this just another bump in the road?

[/dt_call_to_action]