Wine & Spirits

Investment Report

April 2021

Have a question?

support@SureHoldings.com

The image at the top represents the total return on investment for each year from 2012 to 2019. This is the total return thus far for each year invested. The best performing year is our investments made in 2015. Showing a long term investment like wine can really pay off.

If you want to learn how we are achieving high growth, start a wine portfolio or add funds to your existing portfolio today. Choose an Investment Package HERE

The major indices table below, compares the Invest Into Wine Index with the London Vintners Exchange Index and some of the world’s stock markets.

Fully managing your portfolio is part of the standard service

We have four teams managing your portfolio.

- Wine Research – Source and negotiate new wines.

- Portfolio Analysis – Check your portfolio and look for wines that need to be liquidated and allocate new wines to your portfolio.

- Logistics – Organise the correct delivery of new wines into the Bonded Warehouse to ensure a smooth collection and no hiccups along the way.

- Billing – Bill the new wines to your portfolio and update the live portfolio for your reading pleasure.

If you did not request for your portfolio to be managed, contact us immediately to get it switched on to maximize the return on your investments.

Read more on the links below:

Investment Statement Discretionary investment managed portfolioCode of Ethics

Discretionary Investment Managed portfolio Agreement

Email support@sureholdings.com

to confirm your portfolio is under management to maximize on your returns.

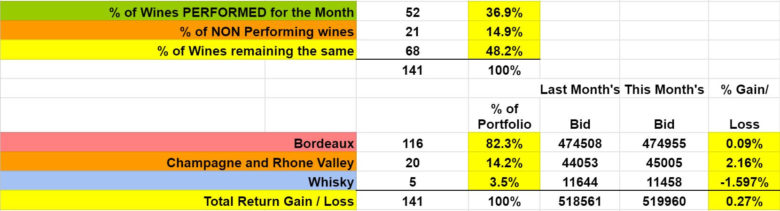

The Figures for March

This month’s valuations showed the Bordeaux market has increased by 0.09% for the month. Champagne and Rhone Valley wines have increased 2.16%.

– 36.9% of the wines valued showed a positive return, while 14.9% showed a negative return and 48.2% remained the same.

– 82.3% of our portfolio is Bordeaux while 14.2% is Champagne and Rhone Valley and our new addition of Whisky investments make up 3.5%

– The overall change for ALL the wines valued this month was UP +0.27%

Scroll down for the winners and losers for March versus April.

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices, are reflected in your online portfolio every month.

Please log on to our website SureHoldings.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

To view our terms and conditions click here

We just finished our yearly audit. What a blast that was! Whenever we get a new auditor, we spend weeks explaining how our business works and often get comments like “you mean your customers don’t drink the wine?? And they don’t have it delivered??”

Then we spend another few weeks providing evidence that the wine really exists in the warehouses.

So on with what we promised.

There’s a degree of urgency in this report and I’m going to get straight to the point.

The global economy is already experiencing hyperinflation.

If you’re not sure what that is, I will explain in more detail later on. I will also show evidence based analysis why we are entering hyperinflation on a global scale.

If you don’t enjoy reading long emails, here are the main points:

-

Commodities are increasing around the world at exponential rates.

-

Currencies, You can not see them weakening or strengthening enough to call it hyperinflation. That’s because ALL currencies are weakening in tandem!

-

Obama printed 800 Billion in 2009 after the ’08 crash.

-

Trump and Biden printed 3 trillion in the last 2 stimulus packages.

-

Every government in the world has been printing excessive amounts of money to manage the economy around the pandemic…

A few months ago, Biden was talking about a 3 trillion stimulus followed by a 10 trillion stimulus!

He is NOT alone, virtually all the governments in the world are pushing for more stimulus. It really is the only tool they have to try to stimulate the economy.

But suddenly Biden is not talking about these huge stimulus packages anymore.

– Wonder why? Because his team of economists see that hyperinflation is already here.

Ask your friends or business partners if their business is doing well or badly at the moment? How many of them are doing well?

Our business has QUADRUPLED in the last six months. Yes QUADRUPLED ! And that is NOT normal, we didn’t even spend any money on advertising..

I spend a lot of my time talking with close friends who are very wealthy investors, and everyone I talk to is doing extremely well. In fact, I’ve yet to find someone who is telling me they are struggling financially right now in this economy.

And the 1000’s of percent growth in Cryptocurrency? How do we explain that? The money has to come from somewhere doesn’t it?

The best way to combat hyperinflation is to buy Assets. Because assets increase during hyperinflation.

NOT the money you’re keeping in the bank.

Your cash is devaluing and becoming WORTHLESS every day longer you keep it as cash! We have the illusion of getting richer, when in reality we are becoming poorer.

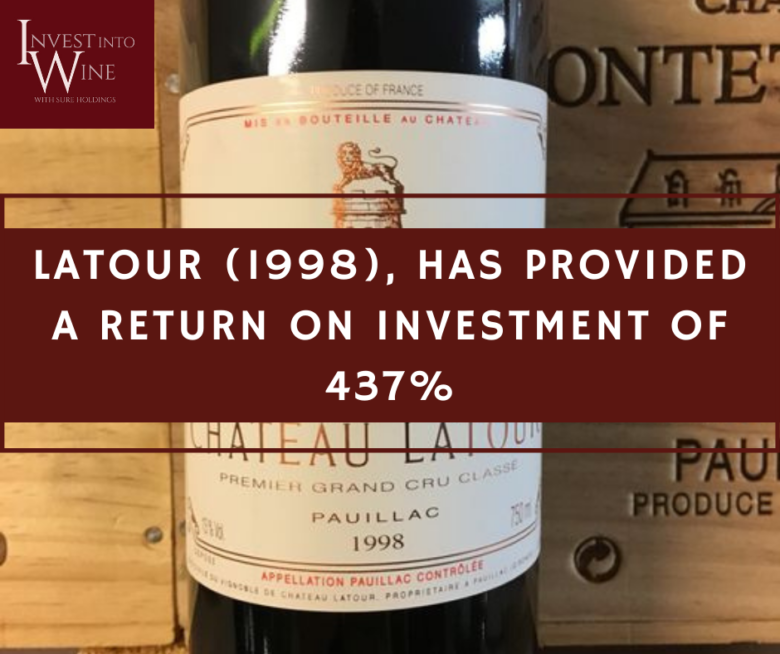

So the best solution is to invest in fine and rare wine and whisky, because it is one of the best hedges you can make against hyperinflation and the current economical situation that we are going through. This wine investment market is already started to boom. We know because we are part of it.

Real estate is another good asset to hedge hyperinflation, but the real estate market has been going crazy in almost every country I have looked at.

Remember I have investors in Asia, Europe, Middle East and America. And everyone tells me their property market is hot right now.

Right time to buy real estate? Probably not, but getting into debt is a good thing right now. As cash becomes worthless, your debt becomes cheaper. (I just dislike debt, which is a personal opinion not an analysis).

Of course you may think we are biased, asking you to consider wine right now, but to be fair, we are so busy that I would rather not take on more business to maintain our service level.

But if I didn’t send you this email and next year you see wine prices up so high that you cant afford them. Well….I wouldn’t be doing my job properly, would I?

The key piece of advice here is to buy assets.

But don’t go buying commodity futures unless you are really an expert in commodity trading as its easy to lose a huge amount of money. I know, because I have been there many years ago.

Commodity prices are already sky rocketing out of all proportions. Let us hope there is a plan to curb this inflation of asset prices.

Wine or whisky, are going to bode well over the next 1-2 years. Not to mention the growth potential is huge.

Wine and whisky are some of the few markets where prices have remained stable since the start of the pandemic.

They havent gone crazy high and they haven’t fallen, but they have been appreciating in value.

Which opens up a great opportunity on the upside for wine and whisky to increase substantially.

Scroll down for the evidence.

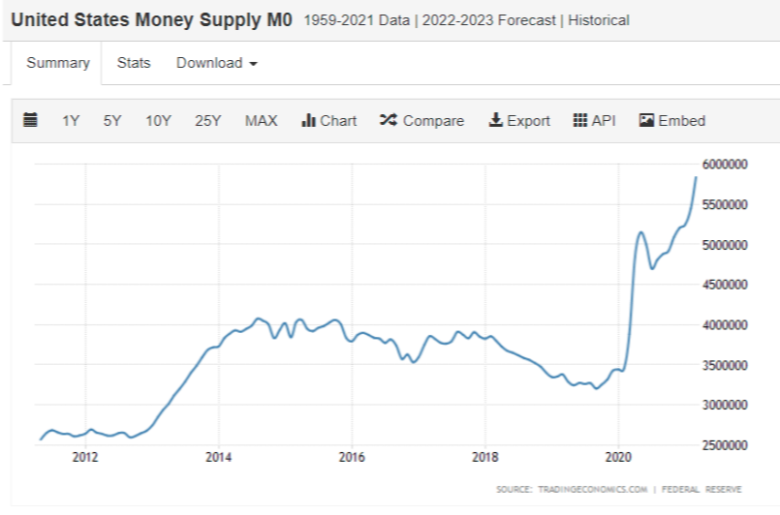

Chart above: U.S money supply 8 Year Chart

- In 2020 U.S money supply was 325 million per month.

- In 2021 its risen to nearly 600 million a month.. and is rising fast compared to the last 8 years.

- The USA is not alone, all governments are doing the same in hopes to stimulate the economy post pandemic.

- In one year, the US Dollar has weakened against the GBP from 1.2 to 1.398 – More than a 15% depreciation in the dollar against the UK pound.

- But the UK economy has suffered badly from the pandemic.

- The assumption is that the US Dollar has weakened due to the fed printing excessive amounts of US Dollar compared to the UK.

- Not from the UK economy strengthening.

- A good example of what happens during hyperinflation.

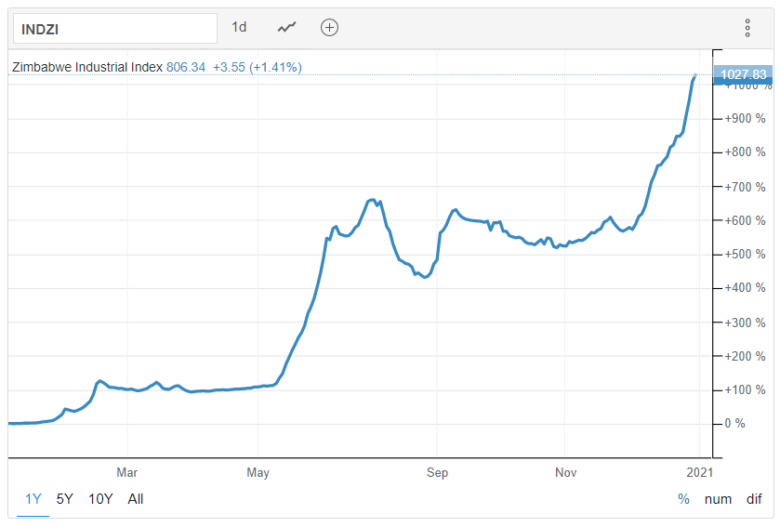

- The Zimbabwe stock market increased 8016 Points or 1,045.99% since the beginning of 2021

- According to trading on a contract for difference (CFD) that tracks this benchmark index from Zimbabwe.

- Well known for their government over printing money supply which caused serious hyperinflation.

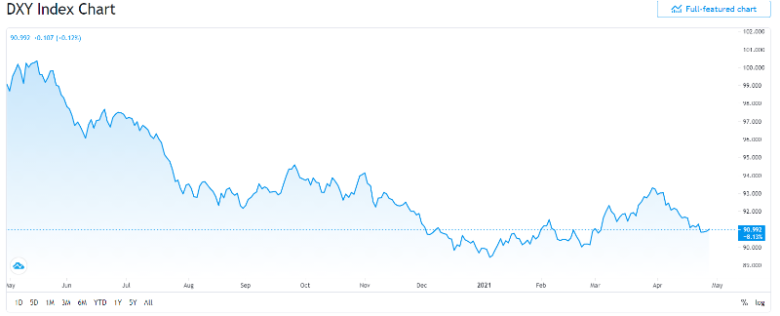

Chart Above: The U.S. Dollar Index

- Tracks the strength of the dollar against a basket of major currencies.

- Note the major weakening.

- U.S. Dollar Index goes up when the U.S. dollar gains “strength” (value), compared to other currencies.

The following six currencies are used to calculate the index:

Euro (EUR) 57.6% weight

Japanese yen (JPY) 13.6% weight

Pound sterling (GBP) 11.9% weight

Canadian dollar (CAD) 9.1% weight

Swedish krona (SEK) 4.2% weight

Swiss franc (CHF) 3.6% weight

- Corn has risen from $539 on April 1st, 2021 to the current price of $740 on May 1st, 2021.

- This is an increase of 37% in just one month!

- The growth from 2016 prior to April 2021 was $335 to $539 is 61% in 5 years,

- The unprecedented growth of corn in just one month.

Chart Above: Wheat 5-year chart.

- Wheat futures increased from $486 on 29 June 2020 to $739 on May 1st, 2021

- An increase of 62% in just 11 months.

- The growth from 2016 to April before the sudden increase was $335 to $539 is 61% in 5 years.

- The unprecedented growth of wheat in just 11 months.

Chart Above: Lumber 5-year Chart

- Lumber has increased from $611 in June 2020 to $1418.50 on May 1st, 2021

- This is an increase of 132% in just 12 months!

- The growth from 2016 prior to June 2020 was insignificant.

https://fortune.com/2021/04/27/lumber-prices-are-up-232- and-it-could-spiral-out-of- control-in-the-next-few-months /

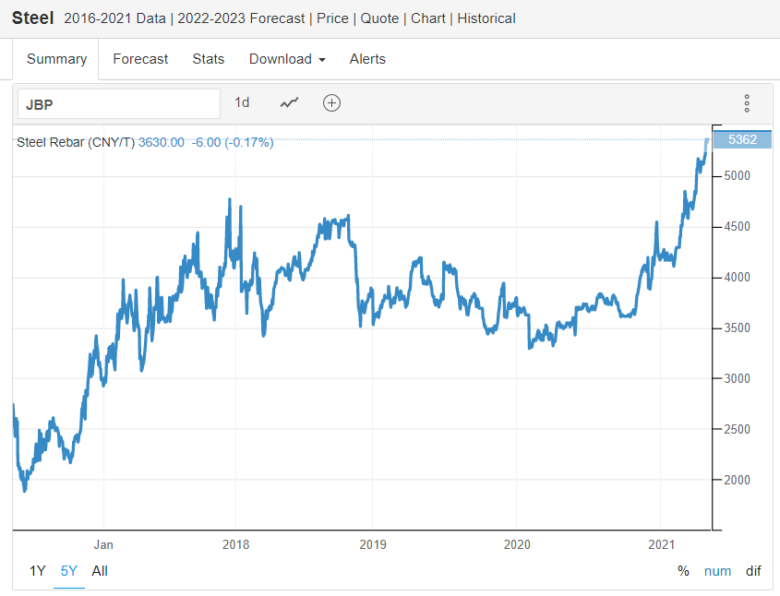

Chart Above: Steel Prices 5-year chart.

- Steel prices have increased from 3515 Yuan/tonne on 3rd May 2020 to the current price of 5342 on 27 April 2021.

- An increase of 52% in just 12 months!

- The unprecedented growth of steel

- Note the sudden increase started in Feb 2020.

The solution to this problem is Investing in stable assets

- Wine and Whisky investing has been around for centuries. It has overcome many recessions and wars in history. There is a reason why it always succeeds. Simple supply and demand, the oldest form of micro economics, used since the 1890s.

- Buy real estate and remain in debt. Don’t try to pay off your mortgage during this period.

- Debt becomes cheaper since money is cheap with record low interest rates that expect to remain here for several years.

- Invest in a hard asset managed fund.

- Invest in Crypto Currency. Even if its a small amount, put something into crypto currency. Because the growth of this space is so phenomenal that even a small investment could pay off handsomely for you in the future. It will also act as a hedge in your portfolio of cash and stocks.

- I’ve been buying crypto since 2012. Its been an amazing journey.

Please email Support@SureHoldings.com