Wine & Spirits

Investment Report

September 2021

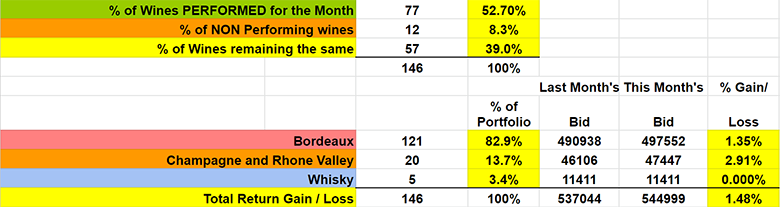

The wine market has shown increased activity this past month. Buyers are chasing diminishing supplies of top Bordeaux wines across the globe. Only 8.3% of wines showed a negative return on the month, versus 52.7% which were UP for the month.

Is this aggressive market movement related to a possible tipping of the global economy? Its starting to look that way. A key indicator in a change in the economy is when risky assets are sold to buy safe assets.

Today in the stock markets the energy, commodity and industrial sectors took a hit including tech and crypto. However a 7% dip in BTC is just another buying opportunity.

With the talk of tapering interest rates and fears about the debt of the Chinese company Evergrande, which alone counts for about 40% of high yield debt issued by Chinese real estate developers.

This could be a move from risk into safe havens. As we are seeing with the growth of the wine market lately. Keep watching and keep buying wine, this market is likely to stay hot for a while.

Have a question?

support@SureHoldings.com

Starting a wine portfolio? Open an account HERE.

Add funds to your current portfolio? Click HERE.

We will source the best investment wines below market value according to your budget and add them to your portfolio.

Need to take funds out of your portfolio? Click HERE

Hope you are keeping well. Have a great weekend.

Kind regards

James Pala

Europe’s No 1 Wine Investment Analyst

Founder SureHoldings.com

Compare the Invest Into Wine Index with the London Vintners Exchange Index and the world’s stock markets in the table below.

Performance for 2021

| Invest Into Wine Index | + 5.41% |

| Liv-ex Bordeaux 500 | + 6.62% |

| Dow Jones | + 10.99% |

| Nasdaq Composite | + 14.16% |

| UK FTSE | + 7.79% |

| Shanghai Comp | + 4.06% |

If you are selling wine,

Champagne has a lot of interest, same with the top Bordeaux. But the top Bordeaux will be a hot commodity for a while if you can get your hands on them, don’t let them go so easily.

If a wine is in the “for sale” section of your portfolio it could already be sold and re-allocated to new wine. A liquidation form must be completed before placing a wine for sale to ensure it is not re-allocated.

What are the best investment wines to buy now?

First growth high-rated vintages although hard to find, will give some excellent growth over the next 1-2 years. Second growth wines are in high demand but they will appreciate later as the market runs dry of first growths.

Champagne and Rhone Valley are a much lower entry points for investment. But they can be a longer-term investment return, if you are prepared to wait, the growth can be excellent.

Latest Offers are emailed every Monday and Thursday from WineTrade@SureHoldings.com

Fully managing your portfolio is part of the standard service

We have four teams managing your portfolio.

- Wine Research – Source and negotiate new wines.

- Portfolio Analysis – Check your portfolio and look for wines that need to be liquidated and allocate new wines to your portfolio.

- Logistics – Organise the correct delivery of new wines into the Bonded Warehouse to ensure a smooth collection and no hiccups along the way.

- Billing – Bill the new wines to your portfolio and update the live portfolio for your reading pleasure.

If you did not request for your portfolio to be managed, contact us immediately to get it switched on to maximize the return on your investments.

Read more on the links below:

Investment Statement Discretionary investment managed portfolioDiscretionary Investment Managed portfolio Agreement

Email support@sureholdings.com

to confirm your portfolio is under management to maximize on your returns.

The Figures for August

This month’s valuations showed the Bordeaux market has increased by 1.35% for the month. Champagne and Rhone Valley wines have decreased 2.91%.

– 52.7% of the wines valued showed a positive return, while 8.3% showed a negative return and 39% remained the same.

– 82.9% of our portfolio is Bordeaux while 13.7% is Champagne and Rhone Valley and our new addition of Whisky investments make up 3.4%

– The overall change for ALL the wines valued this month was UP +1,48%

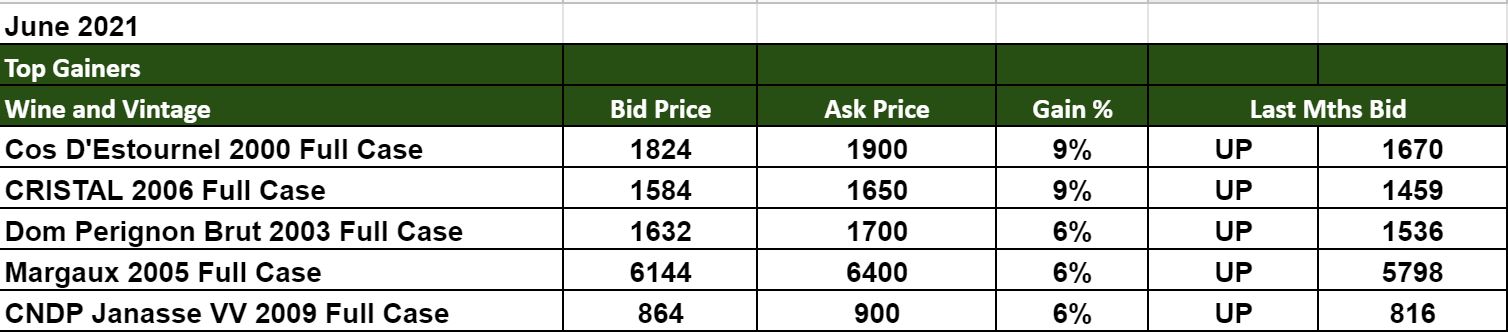

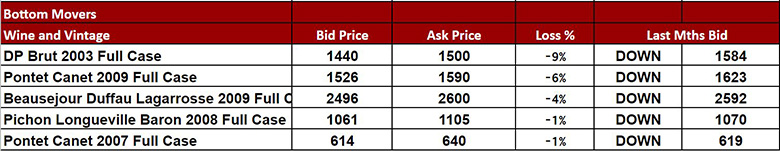

Scroll down for the winners and losers for August versus September

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices, are reflected in your online portfolio every month.

Please log on to our website SureHoldings.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

To view our terms and conditions click here