As interest rates rise, stock markets plummet and take a dive. The fine wine market remains upbeat and stable. The latest vintages for the famous Bordeaux En primeur campaign has just began.

Fine wine investment market performance:

Overall performance of the wine market was good for the current month, the total Bordeaux valuations were up 1.48% while Champagne & Rhone Valley market was up 2.52% for the period of March.

Have you seen our new Blog thats now up and running?

https://sureholdings.com/blog/

There is a new pricing page on the home page. Please familiarise yourself with the new charges as per our current terms and conditions. These changes in fee schedule will only apply in 2023 for existing clients.

The goal is to price your storage fees in US Dollar in future and implement an auto credit card debit system for a smoother storage billing process.

We’ve been having a superb year, most wines have increased in value around 15% in just 12 months. It’s been an amazing year, last year was also solid performance.

The stock markets have been hit lately and also interest rates have been going up which will affect the real estate market.

There’s a huge opportunity in wine investing right now because investors always look at putting money into safer havens when the stock market is falling. You should consider increasing the size of your portfolio.

Interest rates will continue to rise.

This will affect the property market. Property prices are already overpriced & went up too fast during the pandemic. When any market rises too quickly it will come down also quickly.

Stocks are also overpriced, the same problem as real estate. It’s been a good run in the stock market but it is coming to an end.

Fear is starting to set into the market.

– Companies have been allowed to buy shares in their own company using cheap money from the banks with low-interest rates for way too long.

They can’t sell shares to pay back the bank if their stock price plummets.

Some companies will get stuck with this. I expect a few companies to go bankrupt because of it.

– As usual the bad news in the media will create more fear.

When fear sets in, nobody wants to invest. Money then gets stuck with no flow. Usually investors run into hard assets like wine investing because it’s considered a safe haven to protect capital, but usually it means wine investments will go up aggressively.

The dollar is weakening & American products will become cheap. But they’re already expensive compared to most countries.

This is a weird one because inflation is making everything more expensive. Two negative points don’t make a positive one.

– We are long overdue for a correction, I could never understand how we were bullish during the pandemic.

A crash happens every 10 years usually. We should have had one around 2020. If it happens much later past the 10 year cycle, then it usually means a bigger crash.

– Governments printed too much money to get through the pandemic. Now they’re even more broke than before.

– Someone has to pay back all the debt. They will call on the people to pay it back.

Inflation is going to continue.

Don’t forget In a recession, people drink alcohol. Hence wine investing is the best place to be right now.

Protect your capital and give yourself a great chance to find solid profits.

Did you get caught up in the recent stock market dip?

Better to maintain cash and wait for the right wine investment to come along.

BoozCoin.com – The first crypto currency for the $1.5 Trillion alcohol industry.

If you are interested in cryptocurrency, or you are looking for bigger growth potential in your investment portfolio. Our cryptocurrency launch has been going very well. We have completed the seed round and phase 1 completion for the PRE-ICO.

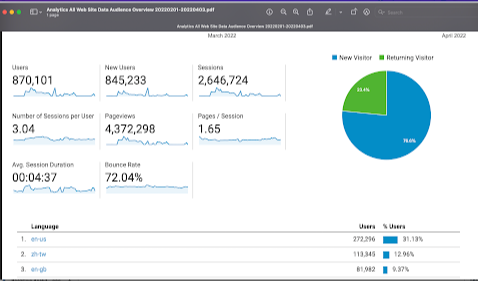

The project has acquired over 10,000 investors signed up to BoozCoin.com with 24,000 members in the BoozCoin telegram channel. Below is a chart showing the traffic to the registration page in the last 30 days. Which shows over 4.3 million page views in 60 days.

The current stage 2 is now opened and available to buy at $0.002 /BoozCoin. The minimum investment is $50.00 and the maximum is $5000.00 You need to invest using Cryptocurrency. If you wish to make an investment in fiat currency over $2000.00 email Support@sureholdings.com and we will set it up for you. Sign up at BoozCoin.com for the PRE-ICO. ”

Compare the Invest Into Wine Index with the London Vintners Exchange Index and the world’s stock markets in the table below.

Performance for 2022 |

Year to Date |

|---|---|

|

Invest Into Wine Index

|

+ 1.20%

|

|

Liv-ex Bordeaux 500

|

+ 3.15%

|

|

Dow Jones

|

– 12.27%

|

|

Nasdaq Composite

|

- 26.27%

|

|

UK FTSE

|

+ 1.75%

|

|

Shanghai Comp

|

- 13.54%

|

We can source the best investment wines according to your budget and add them to your portfolio. Contact us if you wish to increase the size of your portfolio and grow your future asset holding.

Be the best investor you can be and grow a great wine portfolio for your future.

Kind regards

James Pala

Europe’s No 1 Wine Investment Analyst

Founder SureHoldings.com

If you are selling wine?

Our portfolio management team have been selling some clients wines this month, but due to the growth spurt in the market, we have eased off selling aggressively for you to enjoy the growth in the wines currently invested.

What are the best investment wines to buy now?

Prices are difficult to negotiate lower than market price. Stock is limited, any stock requests or increases to your portfolio require around 2-4 weeks’ notice to find stock at the best price.

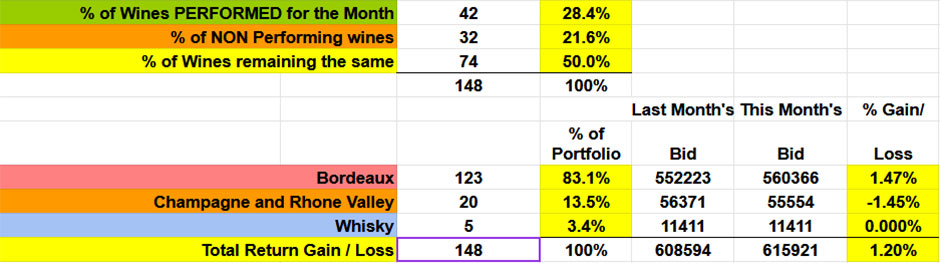

The Figures for May

This month’s valuations showed the Bordeaux market has increased by 1.48% for the month. Champagne and Rhone Valley wines have increased by 2.52%.

– 45.9% of the wines valued showed a positive return, while 13.5% showed a negative return and 40.5% remained the same.

– 83.1% of our portfolio is Bordeaux while 13.5% is Champagne and Rhone Valley and our new addition of Whisky investments make up 3.4%

– The overall change for ALL the wines valued this month was UP +1.58%

Scroll down for the winners and losers for April versus May

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices are reflected in your online portfolio every month.

Please log on to our website SureHoldings.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

To view our terms and conditions click here

Did you know we offer a full bespoke service?

This is how your portfolio is managed.

- Wine Research – Source and negotiate new wines.

- Portfolio Analysis – Assess your portfolio for wines that need to be sold and allocate new wines to your portfolio.

- Logistics – Manage the delivery and receipt of wines with new buyers and sellers into the Bonded Warehouse in UK and France.

- Billing – Monitor funds from your wine sales and bill new wines to your portfolio to ensure an efficient cash flow to maximize your invested funds.

Read more below:

Investment Statement Discretionary investment managed portfolio

Discretionary Investment Managed portfolio Agreement

Email support@sureholdings.com to confirm your portfolio is under management to maximize your returns.