Uncorking Opportunities: A Look at Wine Investment Trends in October 2023.

Dear Investor,

Fill out this form to appy for a monthly investment plan to grow your wine portfolio more consistently: https://docs.google.com/forms/d/e/1FAIpQLSdpo4nNFSSFjxMFZlK4-Nli_LOfOn2tKb9zo1-dOhYRt2XMIg/viewform

Summary:

Asia’s big three economies grew this year thanks to consumer spending, but the region’s recovery is losing steam.

IMF expects growth in Asia and the Pacific to rise from 3.9 percent in 2022 to 4.6 percent this year. This is because of China’s post-reopening rebound and stronger-than-expected growth in Japan and India in the first half of the year. Consumers spent more on services using their pandemic savings.

But Asia’s growth is still lower than before the pandemic and hit by global shocks. Forecast for next year was lowered to 4.2 percent, from 4.4 percent in April. This is because of slower growth and investment in the third quarter, due to weaker external demand and falling real estate investment in China.

China’s economy is slowing earlier than expected. Growth is expected to increase to 5 percent this year, but slow to 4.2 percent next year amid the property-sector slump, down from 4.5 percent in April.

The slowdown in China would normally be offset by faster growth in the US and Japan, but not this time. The US economy is strong in services, not goods, which doesn’t boost demand for Asia. And US policies are shifting demand from foreign to domestic sources, reducing imports from Asia.

The adjustment in China’s property sector and the slowdown in economic activity will spill over to the region, especially to commodity exporters with close trade links to China. In the long term, an aging population and slowing productivity growth will also dampen growth in China and the rest of Asia and beyond. In a downside scenario where “de-risking” and “re-shoring” strategies take hold, output could drop by up to 10 percent over five years in the Asian economies most linked to China’s economy.

Disinflation is on track in Asia, with inflation expected to return to target ranges next year in most countries. This is faster than other regions, where inflation is high and expected to fall within target only in 2025.

Some countries like Indonesia have already brought inflation back to target after big increases last year. In contrast, inflation in China is below target and—with demand weak amid stress from the property sector—is expected to rise slowly due to policy stimulus.

Inflation has risen in Japan, where the central bank has changed its yield curve control policy twice to manage risks. Japanese investors are active in global markets, so these policy actions affected other bond markets. These could become bigger if monetary policy normalizes more in the region’s second-largest economy.

The global environment is very uncertain, and while risks are more balanced than six months ago, Asia’s policymakers must stay alert to ensure growth and stability.

On the downside, a longer real estate crisis and limited policy response in China would deepen the regional slowdown. And a sudden tightening of global financial conditions could lead to capital outflows and pressure on Asia’s exchange rates that would threaten disinflation.

Countries with inflation above targets, such as Australia, New Zealand, and the Philippines, should keep reducing inflation by keeping monetary policy tight until inflation falls to target and expectations are stable.

In many emerging market and developing economies, including Indonesia and Thailand, financial conditions have stayed easy and real policy rates are close to neutral levels, reducing the need for an early easing of monetary policy.

Tight monetary conditions are hurting financial stability—through the real estate sector and indebted companies. And with public debt still high across most of the region, the gradual fiscal consolidation should continue to create space and ensure debt sustainability. For those emerging market and developing economies like Sri Lanka are facing funding stress on external markets.

As long-term prospects dim, with several wars in Ukrain and Palestine, there are likely to be impacts from these events that will cause turbulence in some industries within the stock market.

In this context, fine wine has proven its resilience and appeal as an alternative asset. Fine wine prices rose by 13 per cent in 2020, outperforming most financial assets. Fine wine markets kept their upward trend in 2021, driven by strong demand from Asia and rising interest from new investors. Fine wine is also less affected by inflation than other assets.

Fine wine investment can offer several benefits for investors who want diversification, stability, and long-term returns. Fine wine has a low correlation with other asset classes. Fine wine also has a limited supply and a growing demand, which support its price appreciation over time. Fine wine can also provide hedging opportunities against currency fluctuations.

One way to invest in fine wine is to use a professional service provider, such as Sure Holdings, which can help investors with selecting, buying, storing, managing, and selling fine wines. Sure Holdings uses proprietary AI-driven models to identify wines with the best value and growth potential. Sure Holdings also provides market insights, analysis, and advice to investors.

Fine wine investment is not for everyone, but it can be a rewarding option for those who are looking for a unique and enjoyable way to diversify their portfolio and enhance their returns. Fine wine investment can also be a passion project for those who love wine and want to learn more about it.

Fine wine investment can be both profitable and pleasurable.

Kind regards,

James Pala

Europe’s No 1 Wine Investment Analyst

Compare the Invest Into Wine Index with the London Vintners Exchange Index and the world’s stock markets in the table below.

Performance |

Two Year Period |

|---|---|

|

Invest Into Wine Index

|

+ 5.14%

|

|

Liv-ex Bordeaux 100

|

+ 3.3%

|

|

Dow Jones

|

+ 4.41%

|

|

Nasdaq Composite

|

+ 8.96%

|

|

UK FTSE

|

+ 5.17%

|

|

Shanghai Comp

|

+ 13.48%

|

In the context of wine, the term “vintage” refers to the year in which the grapes used to produce the wine were harvested. It is an important consideration because the weather conditions, such as temperature, rainfall, and sunlight, during that particular year greatly influence the quality and characteristics of the grapes.

Vintage variation is a natural occurrence, and different vintages can result in wines with distinct flavors, aromas, and aging potential. Some years are considered exceptional, producing wines of outstanding quality, while others may be considered average or less remarkable. Winemakers and wine enthusiasts often discuss and evaluate vintages to understand the overall quality and style of the wines produced in a particular year.

For Sellers:

It is important to note that we are currently experiencing a buyer’s market. To facilitate a successful sale, it is advisable to consider adjusting the selling price by 3-5% to attract buyers and increase the likelihood of confirming a buyer in a faster time frame.

For Buyers:

When buying fine wine investments, it is worth noting that first-growth Bordeaux wines can deliver optimal growth and potential returns. However, for individuals with budget constraints, exploring second-growth Bordeaux wines from the 1866 classification can also present exciting investment opportunities with considerable growth potential.

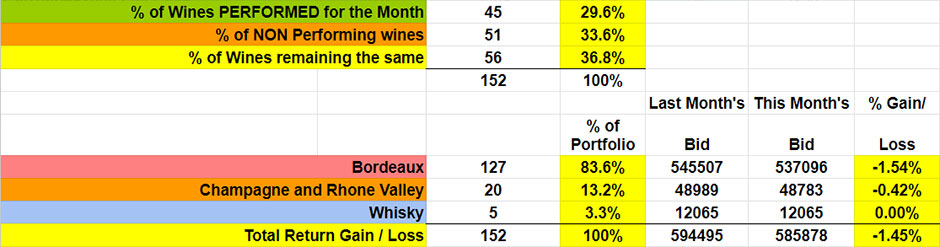

The Figures for October

This month’s valuations showed the Bordeaux market decreasing by -1.54%. Champagne and Rhone Valley wines have decreased by -0.42%.

29.6% of the wines valued showed a positive return, while 33.6% showed a negative return, and 36.8% remained the same.

83.6% of our portfolio is Bordeaux while 13.2% is Champagne and Rhone Valley, with Whisky investments & others make up 3.3%

Overall, there was a -1.45% in the value of all wines this month.

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices are reflected in your online portfolio every month.

Please log on to our website SureHoldings.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

Did you know we offer a full bespoke service?

This is how your portfolio is managed.

- Wine Research – Source and negotiate new wines.

- Portfolio Analysis – Assess your portfolio for wines that need to be sold and allocate new wines to your portfolio.

- Logistics – Manage the delivery and receipt of wines with new buyers and sellers into the Bonded Warehouse in UK and France.

- Billing – Monitor funds from your wine sales and bill new wines to your portfolio to ensure an efficient cash flow to maximize your invested funds.

Read more below:

Investment Statement Discretionary investment managed portfolio

Questions?