Uncorking Opportunities: A Look at Wine Investment Trends in March 2024.

Compare the Invest Into Wine Index with the London Vintners Exchange Index and the world’s stock markets in the table below.

Performance |

Two Year Period |

|---|---|

|

Invest Into Wine Index

|

- 6.46%

|

|

Liv-ex Bordeaux 100

|

- 11.5%

|

|

Dow Jones

|

+ 10.88%

|

|

Nasdaq Composite

|

+ 14.58%

|

|

UK FTSE

|

+ 4.41%

|

|

Shanghai Comp

|

+ 6.37 %

|

In the context of wine, the term “vintage” refers to the year in which the grapes used to produce the wine were harvested. It is an important consideration because the weather conditions, such as temperature, rainfall, and sunlight, during that particular year greatly influence the quality and characteristics of the grapes.

Vintage variation is a natural occurrence, and different vintages can result in wines with distinct flavors, aromas, and aging potential. Some years are considered exceptional, producing wines of outstanding quality, while others may be considered average or less remarkable. Winemakers and wine enthusiasts often discuss and evaluate vintages to understand the overall quality and style of the wines produced in a particular year.

For Sellers:

It is important to note that we are currently experiencing a buyer’s market. To facilitate a successful sale, it is advisable to consider adjusting the selling price by 3-5% to attract buyers and increase the likelihood of confirming a buyer in a faster time frame.

For Buyers:

When buying fine wine investments, it is worth noting that first-growth Bordeaux wines can deliver optimal growth and potential returns. However, for individuals with budget constraints, exploring second-growth Bordeaux wines from the 1866 classification can also present exciting investment opportunities with considerable growth potential.

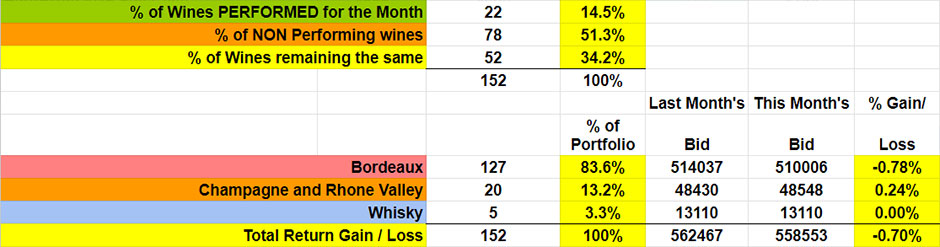

The Figures for March

This month’s

valuations showed the Bordeaux market decreasing by -0.7. Champagne and Rhone Valley wines have increased by +0.24%.

14.5% of the wines valued showed a positive return, while 51.3% showed a negative return, and 34.2% remained the same.

83.6% of our portfolio is Bordeaux while 13.2% is Champagne and Rhone Valley, with Whisky investments and others make up 3.3%

Overall, there was a -0.70% in the value of all wines this month

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices are reflected in your online portfolio every month.

Please log on to our website SureHoldings.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

Did you know we offer a full bespoke service?

This is how your portfolio is managed.

- Wine Research – Source and negotiate new wines.

- Portfolio Analysis – Assess your portfolio for wines that need to be sold and allocate new wines to your portfolio.

- Logistics – Manage the delivery and receipt of wines with new buyers and sellers into the Bonded Warehouse in UK and France.

- Billing – Monitor funds from your wine sales and bill new wines to your portfolio to ensure an efficient cash flow to maximize your invested funds.

Read more below:

Investment Statement Discretionary investment managed portfolio

Questions?