Warm Wishes for a Prosperous New Year!

Warm Wishes for a Prosperous New Year!

Dear Investors,

I hope you enjoyed a wonderful Christmas and New Year surrounded by joy and warmth. As the holiday season now transitions into cherished memories, I wanted to take a moment to express our heartfelt gratitude for your continued trust and partnership with Sure Holdings. Your support has been the bedrock of our success, and we are genuinely appreciative.

May the festivities of the season have brought you moments of happiness with loved ones. Looking forward, we eagerly anticipate the New Year and the promising opportunities it holds for all of us. Here’s to a season of celebration and to the continued success and prosperity we’ll share in the coming months.

Wishing you a fantastic start to the year, filled with happiness, good health, and the promise of a prosperous future.

Warm regards,

Sure Holdings Team!

https://docs.google.com/forms/

Market Outlook

• The current economy for January 2024 is expected to be sluggish, with low growth, high inflation, and rising interest rates. The U.S. and global economies are still recovering from the impact of the Covid-19 pandemic, the Russian invasion of Ukraine, and the conflict in Israel and Palestine. The IMF projects that global growth will fall from 3.5% in 2022 to 3.0% in both 2023 and 2024. The Conference Board forecasts that U.S. growth will slow from 2.4% in 2023 to 0.9% in 2024. The risk of recession is estimated to be 25% by the first half of 2024 and 45% by the second half of 2024.

• The fine wine market outlook for 2024 is bleak, with no indication yet that prices have bottomed out and buyers increasingly focusing on safe bets such as mature Bordeaux. The fine wine market has suffered from the weak macroeconomic environment, the trade war between the U.S. and China, and the oversupply of young vintages. The Liv-ex indices, which track the prices of fine wines, are down by double digits in 2023. Buyers are shifting their attention to the highest-quality vintages, particularly those in their drinking windows, and avoiding newer, less well-established brands. Bordeaux has regained some market share, while Burgundy has seen a sharp decline. Italy, especially Piedmont, has shown some resilience.

• The fine wine market outlook for 2024 is challenging, but not hopeless. There are still opportunities for savvy investors and collectors to find value and quality in the market. The fine wine market is undergoing a correction, which may create attractive entry points for some wines. Buyers can diversify their portfolios by exploring regions and styles that are less affected by the market downturn, such as Champagne. Bordeaux remains the dominant force in the fine wine market, with its proven track record and long-term potential. Burgundy, despite its recent slump, still offers some of the most sought-after and exquisite wines in the world. The fine wine market is resilient and has survived many crises in the past. It may bounce back sooner than expected, as demand recovers and supply stabilizes.

James Pala

Europe’s No 1 Wine Investment Analyst

Sources:

https://www.thedrinksbusiness.

https://www.jpmorgan.com/

https://abcnews.go.com/

Compare the Invest Into Wine Index with the London Vintners Exchange Index and the world’s stock markets in the table below.

Performance |

Two Year Period |

|---|---|

|

Invest Into Wine Index

|

+ 0.97%

|

|

Liv-ex Bordeaux 100

|

- 4.8%

|

|

Dow Jones

|

+ 0.76%

|

|

Nasdaq Composite

|

+ 7.88%

|

|

UK FTSE

|

+ 2.82%

|

|

Shanghai Comp

|

+ 18.40%

|

In the context of wine, the term “vintage” refers to the year in which the grapes used to produce the wine were harvested. It is an important consideration because the weather conditions, such as temperature, rainfall, and sunlight, during that particular year greatly influence the quality and characteristics of the grapes.

Vintage variation is a natural occurrence, and different vintages can result in wines with distinct flavors, aromas, and aging potential. Some years are considered exceptional, producing wines of outstanding quality, while others may be considered average or less remarkable. Winemakers and wine enthusiasts often discuss and evaluate vintages to understand the overall quality and style of the wines produced in a particular year.

For Sellers:

It is important to note that we are currently experiencing a buyer’s market. To facilitate a successful sale, it is advisable to consider adjusting the selling price by 3-5% to attract buyers and increase the likelihood of confirming a buyer in a faster time frame.

For Buyers:

When buying fine wine investments, it is worth noting that first-growth Bordeaux wines can deliver optimal growth and potential returns. However, for individuals with budget constraints, exploring second-growth Bordeaux wines from the 1866 classification can also present exciting investment opportunities with considerable growth potential.

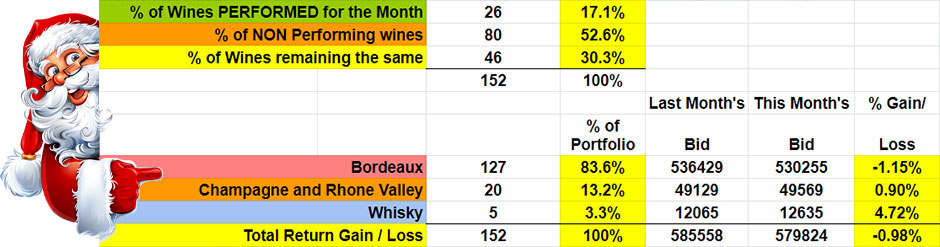

The Figures for December

This month’s valuations showed the Bordeaux market decreasing by -1.15%. Champagne and Rhone Valley wines have increased by 0.90%.

17.1% of the wines valued showed a positive return, while 52.6% showed a negative return, and 30.3% remained the same.

83.6% of our portfolio is Bordeaux while 13.2% is Champagne and Rhone Valley, with Whisky investments and others make up 3.3%

Overall, there was a -0.98% in the value of all wines this month.

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices are reflected in your online portfolio every month.

Please log on to our website SureHoldings.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

Did you know we offer a full bespoke service?

This is how your portfolio is managed.

- Wine Research – Source and negotiate new wines.

- Portfolio Analysis – Assess your portfolio for wines that need to be sold and allocate new wines to your portfolio.

- Logistics – Manage the delivery and receipt of wines with new buyers and sellers into the Bonded Warehouse in UK and France.

- Billing – Monitor funds from your wine sales and bill new wines to your portfolio to ensure an efficient cash flow to maximize your invested funds.

Questions?