Uncorking Opportunities: A Look at Wine Investment Trends in June 2023.

Dear Investor,

I hope this message finds you well.

Interest Rates

The Federal Reserve has been on a steady path of tightening monetary policy, raising interest rates 10 times since June 2022. The current Federal Funds Rate stands at 5.00% to 5.25% in the USA, a level not seen since 2006.

It is essential to bear in mind that fine wine continues to prove itself as a resilient and valuable asset class.

Currency and Job Market

The US dollar has seen appreciation against most major currencies over the last year, increasing roughly 10%. In tandem, jobless claims have spiked, reaching their highest level since late 2022. This is likely due to the increased implementation of AI technologies and automation, as companies continue to streamline their workforce. The potential long-term implications for the global economy warrant attention.

Housing Market

In the next five years, the US housing market is predicted to experience a slowdown, with prices either flat or experiencing a modest decline.

Diversification of Investments

In light of these shifting dynamics, investor sentiment appears to be veering towards alternative investments such as fine wine. Investors are increasingly identifying the potential of wine as a store of wealth and a tool to diversify their portfolios. Wine investments have shown a strong performance during periods of economic uncertainty, demonstrating their long-term value stability.

Cryptocurrencies and Precious Metals

Cryptocurrencies and precious metals continue to captivate attention, albeit they bring a distinct set of risks. Cryptocurrencies, including Bitcoin, have a reputation for volatility. Bitcoin prices recently surged over $30,000. Gold prices have also experienced considerable volatility that represents a 7% decline over the last year.

Fine Wine Investments

Given the current market landscape, fine wine remains a compelling choice for investors looking for stability and long-term growth. It’s a tangible asset that offers intrinsic value and boasts a strong history of delivering returns, as evident from your portfolio.

Global Stimulus Packages

Notably, governments worldwide have pumped an estimated $12 trillion into their economies over the last five years via stimulus packages. While these measures aim to stimulate growth, they also contributed to massive inflation. Fine wine investors continue to benefit from inflation as prices are expected to continue rising.

Conclusion

Fine wine remains an attractive option, helping preserve capital, providing diversification, and serving as a store of wealth.

We are offering a monthly wine investors plan, with plans to include a credit card option, whereby you can invest a token amount each month until there is a sufficient amount to invest in a case of wine. Complete this form for further details:

https://docs.google.com/forms/d/e/1FAIpQLSdpo4nNFSSFjxMFZlK4-Nli_LOfOn2tKb9zo1-dOhYRt2XMIg/viewform

Kind regards,

James Pala

Europe’s No 1 Wine Investment Analyst

Compare the Invest Into Wine Index with the London Vintners Exchange Index and the world’s stock markets in the table below.

Performance |

Two Year Period |

|---|---|

|

Invest Into Wine Index

|

+ 14.98%

|

|

Liv-ex Bordeaux 500

|

+ 20.1%

|

|

Dow Jones

|

+ 1.48%

|

|

Nasdaq Composite

|

+ 5.83%

|

|

UK FTSE

|

+ 6.55%

|

|

Shanghai Comp

|

+ 7.91%

|

Our expertise is in sourcing the best investment wines according to your budget & strategy. Contact us if you wish to increase the size of your portfolio and grow your future.

Be the best investor you can be by investing in fine wine for your future.

If you are selling wine?

Sell only first growth wines from your portfolio at year end. Other regions tend to be slower at the end of a bad year for the economy.

What are the best investment wines to buy now?

Buy what is cheap in the market at this period of the year. Look for the bargains, below market stock that can set you up for a good start to a profitable year in 2023.

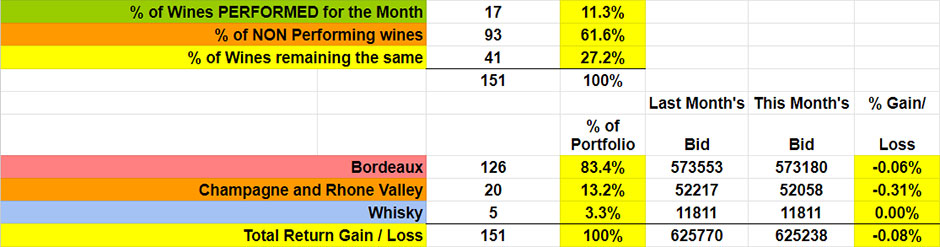

The Figures for July

This month’s valuations showed the Bordeaux market decreasing by -0.06%. Champagne and Rhone Valley wines have decreased by -0.31%.

11.3% of the wines valued showed a positive return, while 61.6% showed a negative return, and 27.2% remained the same.

83.4% of our portfolio is Bordeaux while 13.2% is Champagne and Rhone Valley, with Whisky investments & others make up 3.3%

Overall, there was a -0.08% in the value of all wines this month.

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices are reflected in your online portfolio every month.

Please log on to our website SureHoldings.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

Did you know we offer a full bespoke service?

This is how your portfolio is managed.

- Wine Research – Source and negotiate new wines.

- Portfolio Analysis – Assess your portfolio for wines that need to be sold and allocate new wines to your portfolio.

- Logistics – Manage the delivery and receipt of wines with new buyers and sellers into the Bonded Warehouse in UK and France.

- Billing – Monitor funds from your wine sales and bill new wines to your portfolio to ensure an efficient cash flow to maximize your invested funds.

Read more below:

Investment Statement Discretionary investment managed portfolio

Discretionary Investment Managed portfolio Agreement

Questions?