Uncorking Opportunities: A Look at Wine Investment Trends in August 2023.

Dear Investor,

Implications of Evergrande’s Bankruptcy on the Wine Investment Market

The filing of bankruptcy by China’s Evergrande Group, one of its largest property developers, adds another chapter to the financial turmoil that has dominated headlines and sent shockwaves across global markets. The question that arises for investors is how this could impact the wine investment market.

Chinese Consumer Confidence:

China’s affluent middle and upper classes have been significant players in the wine investment market over the past decade. A severe property crisis, such as the one caused by Evergrande’s default, could dent consumer confidence. This might lead to a short-term pullback in luxury spending, of which fine wine is a component.

Shift in Investment Portfolio:

With the real estate sector, which constituted a significant portion of Chinese investments, now under scrutiny and facing uncertainty, Chinese investors might start diversifying their portfolios. Fine wine, being a tangible asset that has historically shown resilience against economic downturns, might become an attractive alternative for some.

Liquidity Concerns:

Some investors who are overexposed to the Chinese real estate market or to Evergrande directly might face liquidity issues. This could lead to a temporary surge in wine assets being sold off, potentially pressuring wine prices downward.

Currency Fluctuations:

The Evergrande situation, combined with broader concerns about China’s economy, might lead to fluctuations in the value of the Yuan. This could impact the purchasing power of Chinese investors in the global wine market.

Global Economic Impact:

Evergrande’s crisis is not just a Chinese issue but has ramifications for global economies. A slowing Chinese economy can lead to a decrease in global luxury spending, potentially impacting the demand for investment-grade wines.

Long-Term Perspective:

While the immediate effects of Evergrande’s bankruptcy might be felt in the short term, the long-term view for wine investment remains optimistic. Wine’s tangible nature, limited supply, and growing global demand, especially from emerging markets, continue to make it an attractive investment avenue.

In conclusion, while the Evergrande situation introduces a layer of uncertainty to many economic sectors, the fundamentals of wine as an investment remain strong. Investors should remain vigilant, diversify their portfolios, and potentially capitalize on any short-term market anomalies.

We are offering a monthly wine investors plan, whereby you can invest a token amount each month to invest in wine. Complete this enquiry form for more info:

https://docs.google.com/forms/d/e/1FAIpQLSdpo4nNFSSFjxMFZlK4-Nli_LOfOn2tKb9zo1-dOhYRt2XMIg/viewform

Kind regards,

James Pala

Europe’s No 1 Wine Investment Analyst

Compare the Invest Into Wine Index with the London Vintners Exchange Index and the world’s stock markets in the table below.

Performance |

Two Year Period |

|---|---|

|

Invest Into Wine Index

|

+ 12.54%

|

|

Liv-ex Bordeaux 500

|

+ 10.1%

|

|

Dow Jones

|

+ 0.41%

|

|

Nasdaq Composite

|

+ 8.75%

|

|

UK FTSE

|

+ 5.15%

|

|

Shanghai Comp

|

+ 7.43%

|

Our expertise is in sourcing the best investment wines according to your budget & strategy. Contact us if you wish to increase the size of your portfolio and grow your future.

Be the best investor you can be by investing in fine wine for your future.

If you are selling wine?

Sell only first growth wines from your portfolio at year end. Other regions tend to be slower at the end of a bad year for the economy.

What are the best investment wines to buy now?

Buy what is cheap in the market at this period of the year. Look for the bargains, below market stock that can set you up for a good start to a profitable year in 2023.

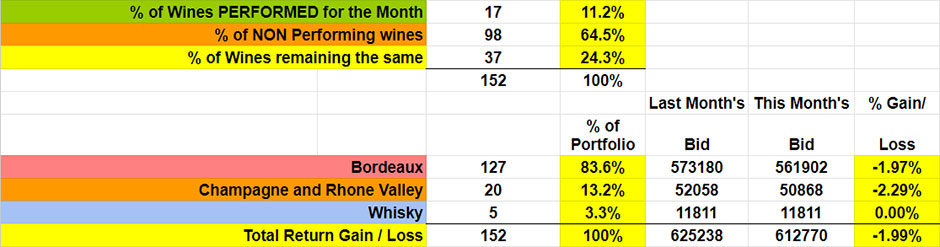

The Figures for August

This month’s valuations showed the Bordeaux market decreasing by -1.97%. Champagne and Rhone Valley wines have decreased by -2.29%.

11.2% of the wines valued showed a positive return, while 64.5% showed a negative return, and 24.3% remained the same.

83.4% of our portfolio is Bordeaux while 13.2% is Champagne and Rhone Valley, with Whisky investments & others make up 3.3%

Overall, there was a -1.99% in the value of all wines this month.

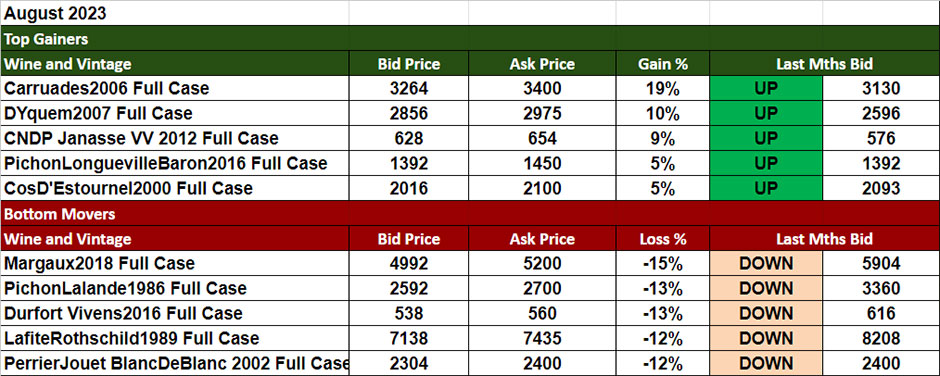

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices are reflected in your online portfolio every month.

Please log on to our website SureHoldings.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

Did you know we offer a full bespoke service?

This is how your portfolio is managed.

- Wine Research – Source and negotiate new wines.

- Portfolio Analysis – Assess your portfolio for wines that need to be sold and allocate new wines to your portfolio.

- Logistics – Manage the delivery and receipt of wines with new buyers and sellers into the Bonded Warehouse in UK and France.

- Billing – Monitor funds from your wine sales and bill new wines to your portfolio to ensure an efficient cash flow to maximize your invested funds.

Read more below:

Investment Statement Discretionary investment managed portfolio

Discretionary Investment Managed portfolio Agreement

Questions?