The fine wine market consistently performed this month. The market continues its upward trend, despite a slightly lesser growth this month than the previous month.

Could it be a breathing point, while the market assesses the latest aggressive growth phase?

This growth pattern has some similarities to the 2009 stock market crash. Just before the end of 2008, asset prices were very high, the stock markets were at an all time high and there were concerns about a potential correction coming. Then AIG and Lehman Brothers collapsed.

What did the wine market do?

Well it saw a minor correction, but in January 2009 it was probably more aggressive than it had been in previous years. That rally continued for 3 years while the global economy was dragged through the mud and the stock market struggled.

They do say history repeats itself. The obvious factor is that today, markets are at an all time high. However there is a major difference. There has been an over printing of money supply which far outweighs that from 2009. We see these effects in current inflation.

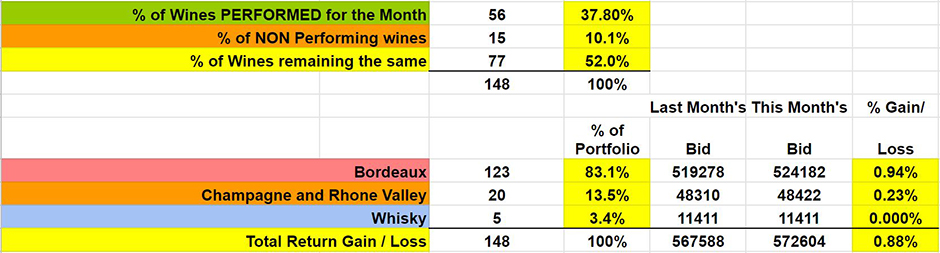

This month over 38% of wines went up in value, versus only 10% that went down.

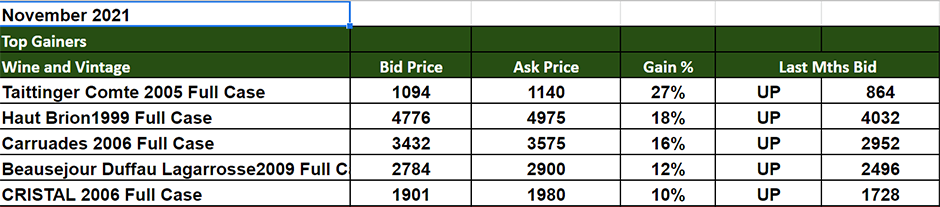

Two of our recommendations Chateau Haut Brion 1999 increased 18% this month and Carruades de Lafite 2006 increased 16%.

The Bordeaux market overall grew by 1%. While Champagne & Rhone Valley a slight move up of 0.23%.

Bitcoin hit an all time high of $68,000 dollars. It has come down to $59,000 past week but still remains very much ahead and trending in the financial news. Have you been investing in Crypto currencies? Look at this coin our founders are launching for the wine & spirits industry. BoozCoin.com – Get on the ICO hot list to participate before its too late.

Compare the Invest Into Wine Index with the London Vintners Exchange Index and the world’s stock markets in the table below.

Performance for 2021 |

Year to Date |

|---|---|

|

Invest Into Wine Index

|

+ 8.55%

|

|

Liv-ex Bordeaux 500

|

+ 8.25%

|

|

Dow Jones

|

+ 16.37%

|

|

Nasdaq Composite

|

+ 23.54%

|

|

UK FTSE

|

+ 12.31%

|

|

Shanghai Comp

|

+ 1.85%

|

Starting a wine portfolio? Open an account HERE.

Add funds to your current portfolio? Click HERE.

We will source the best investment wines below market value according to your budget and add them to your portfolio.

Need to take funds out of your portfolio? Click HERE

Hope you are keeping well. Have a great weekend.

Kind regards

James Pala

Europe’s No 1 Wine Investment Analyst

Founder SureHoldings.com

If you are selling wine?

Our portfolio management team have been selling some clients wines this month, but due to the growth spurt in the market, we have eased off selling aggressively for you to enjoy the growth in the wines currently invested.

What are the best investment wines to buy now?

Prices are difficult to negotiate lower than the market price. Stock is limited, any stock requests or increases to your portfolio require around 2-4 weeks’ notice to find stock at the best price.

Latest Offers are sent to your inbox every Monday and Thursday from WineTrade@SureHoldings.com

The Figures for October

This month’s valuations showed the Bordeaux market has increased by 0.94% for the month. Champagne and Rhone Valley wines have decreased 0.23%.

– 37.8% of the wines valued showed a positive return, while 10.1% showed a negative return and 52% remained the same.

– 83.1% of our portfolio is Bordeaux while 13.5% is Champagne and Rhone Valley and our new addition of Whisky investments make up 3.4%

– The overall change for ALL the wines valued this month was UP +0.88%

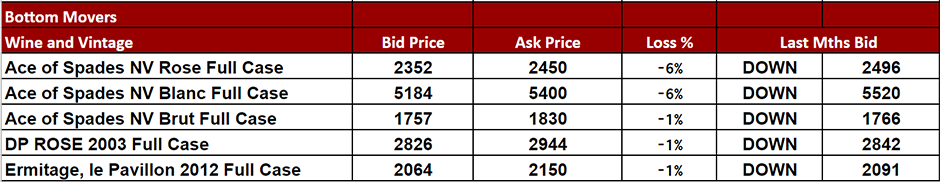

Scroll down for the winners and losers for October versus November

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices, are reflected in your online portfolio every month.

Please log on to our website SureHoldings.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

To view our terms and conditions click here

Did you know we offer a full bespoke service?

This is how your portfolio is managed.

- Wine Research – Source and negotiate new wines.

- Portfolio Analysis – Assess your portfolio for wines that need to be sold and allocate new wines to your portfolio.

- Logistics – Manage the delivery and receipt of wines with new buyers and sellers into the Bonded Warehouse in UK and France.

- Billing – Monitor funds from your wine sales and bill new wines to your portfolio to ensure an efficient cash flow to maximize your invested funds.

Read more below:

Investment Statement Discretionary investment managed portfolio

Discretionary Investment Managed portfolio Agreement

Email support@sureholdings.com to confirm your portfolio is under management to maximize your returns.