Wine & Spirits Investment Report December 2020

Another Increase for the Wine Market through to December !

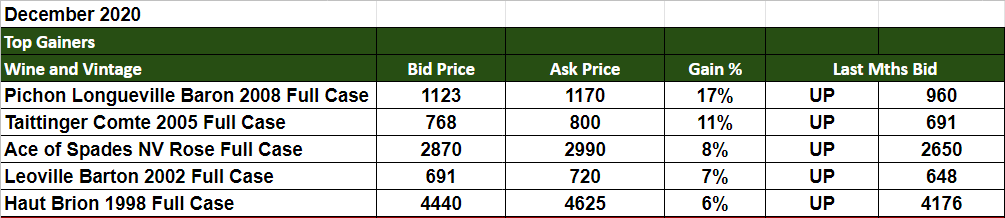

Pichon Baron, the famous second growth rose 17% in one month and Taittinger Champagne 11%, despite a lack of celebratory events due to the pandemic which has led to affecting the Champagne markets.

Good demand for Champagne investments still remains. Could there be anticipation that an excessive amount of corks will be popping when we are finally through the pandemic?

If you are not receiving a call with recommendations and would like one:

Continued….

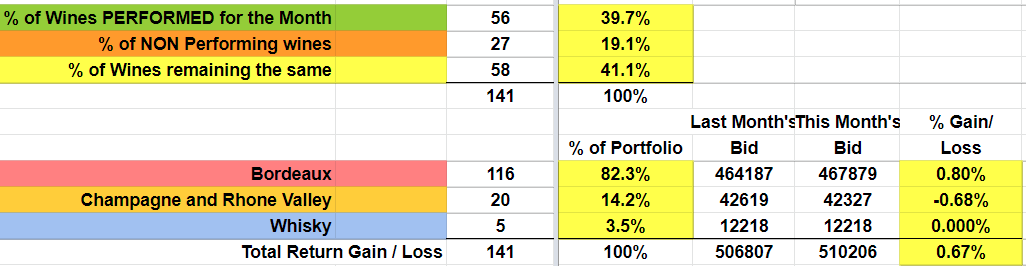

38% % of the market increased in value versus only 19.8% that decreased. The market is confidently moving towards a sellers market as prices maintain their steady growth.

The total overall return for the Invest Into Wine Index was 0.691%

First growths continue to command the direction of the market. But interest in second growths shows an eager market looking for opportunity.

Wine prices need to appreciate more than 1.25% for 3 consecutive months to be regarded as a rally. The boom we are waiting for still holds in the ballast.

How will the wine & spirits investment market perform in 2021?

Will stock markets rally in 2021 or will there be a correction?

The spreads on Whisky’s edge tigheter

There is definitely a buzz in the air when we talk to merchants and distributors about fine & rare whisky.

An increasing number of merchants are improving their stock levels as prices become more competitive for some of the leading brands.

When an asset has few buyers & sellers. The spread between the buy and sell price is wider. When these two prices are closer its because there are more buyers and sellers so the market becomes more competitive.

Same can be said about volume. Sellers are willing to work on lower margins because of the bigger volume they can buy/sell. So the spread becomes tighter.

Is Whisky better sold via auction than wine?

When we started investing in wine 20 years ago, auctions were a great way to find the best prices for rare wines.

Auctions are still popular for wine, but now prices outside of an auction can be found much cheaper. Primarily because the market has way more buyers & sellers than 20 years ago.

In the New Year we are going to be auctioning off some of our whisky to further test the resale market. An auction can fetch considerably more for a whisky than the average market price.

Whisky is still in its early stages as an investable asset class and has less sellers than the rare wine market.

Collectors looking for a specific bottle may be prepared to pay a higher premium at auction than the open market. Demand is strong and quantity is very limited.

Remember most collectors buy to collect and then consume.

Investors buy to speculate until the value is above their purchase price.

Continued…

- While conducting valuations on whisky, our research team found that the data is sparse. Due to a lack of sellers in the marketplace.

- We are buying and recommending whisky’s that are priced between $500 and $5000 USD per bottle.

- An easy entry point for our investor base. Allowing more investors to participate.

- Around 60% of Suppliers we know from the last 20 years offer fine & rare whisky bottles way below what the auction prices sell for.

- But we know which merchants sell on margins of 5% – Crucial to finding whisky below an auction price.

- More than 70% of wine and spirits merchants work on profit margins of 20-30%, this can kill your return on investment.

Stay tuned and reply fast if you are interested in the next parcel.

Wine & Whisky remains buoyant regardless of the state of the economy

When facing an economy in the toilet, its a breath of fresh air to see the fine and rare wine & spirits market remain robust.

It has been fairly resilient this year. Even with a bad start to the year, it has recovered and looks to be in a great position for 2021.

But why?

Prices have not escalated to an overpriced state.

There are still lots of bargains and sellers needing liquidity as the pressure of the pandemic weighs on other income streams.

Demand for hard assets is strong.

An overpriced stock market, investors consider alternatives to hedge their positions.

Currency markets are in free fall. Hard assets become cheaper to buy.

China and parts of Asia have the pandemic under control and they are big buyers.

If you are selling wine, We will edge the sell prices UP 1% higher on January 1st 2021 as the market is building up good activity. Place your position 2%-4% lower than the bid price to entice a buyer for a quicker sale.

What wines would be best to buy right now? Bordeaux is our favorite market. Champagne is a good long term BUY, in anticipation of the world re opening and events starting back again.

Look out for an email that is sent every Monday and Thursday from WineTrade@SureHoldings.com

Important Update When Checking Your Wine Portfolio

Your portfolio advisor will guide you on the correct price to sell your wine if you need assistance, email support@sureholdings.com to check the market price before selling

The major indices table below, compares the Invest Into Wine Index with the London Vintners Exchange Index and some of the world’s stock markets.

Happy Hunting!

Kind regards

James Pala

Europe’s No 1 Wine Investment Analyst

|

Performance for 2020 ‘Year To Date’

|

|

|---|---|

|

Invest Into Wine Index

|

+ 6.74%

|

|

Liv-ex Bordeaux 500

|

+ 2.96%

|

|

Dow Jones

|

+ 4.67%

|

|

Nasdaq Composite

|

+ 40.15%

|

|

UK FTSE

|

– 15.62%

|

|

Shanghai Comp

|

+ 10.5%

|

– 42.7% of the wines valued showed a positive return, while 20.6% showed a negative return and 44.3% remained the same.

– 82.3% of our portfolio is Bordeaux while 14.2% is Champagne and Rhone Valley and our new addition of Whisky investments make up 3.5%

– The overall change for ALL the wines valued this month was UP +0.67%

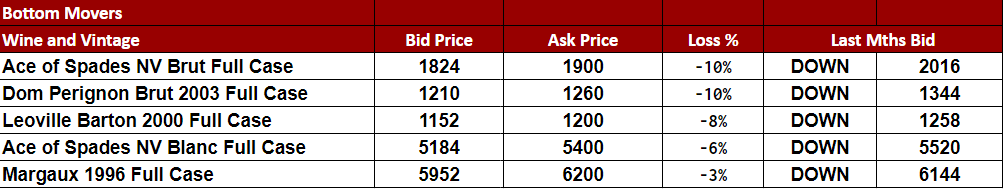

Scroll down for the winners and losers for November versus December.

Below are the five, top and bottom movers compared to the previous month. Over 100 wines are valued each month. The wines valued are ALL OUR recommendations from the last fifteen years.

The new prices, are reflected in your online portfolio every month.

Please log on to our website SureHoldings.com to view your wine portfolio and email us back if you wish to ask anything about which wines that can help build your wine portfolio.

Yours Sincerely,

Client Services

To view our terms and conditions click here

Markets and The Economy

Can Bitcoin go higher?

In November 2017 Bitcoins hit its first major high of $19283 USD per bitcoin for a brief moment. It then came crashing down to $7000 by March 2018. Staggering growth and staggering losses in such short spaces of time.

Recently it hit over 23,000 setting new record highs. The question everybody is asking is, can it go higher?

Bitcoin is not for the feint hearted, its reason for the latest rally was an adoption from Paypal.

Paypal have added Bitcoin on their platform effectively allowing it to be bought & sold or used as a form of payment.

But it is still a long way off adoption into mainstream as a currency. Mainly due to the technical complexity in managing it as a day to day currency.

Can Bitcoin go higher?

Nevertheless it is on its way, and could be a form of currency in 2021 or 2022.

Its adoption depends on whether governments allow it, or if they can stop it.

The problem with Bitcoin and governments is that the public ledger for bitcoin does not show the names of those transacting the coin. Which allows for unscrupulous parties to trade the coin for illegal or explicit means.

Bitcoin is still a wild speculation, go in with caution. Invest what you can afford to lose. Its better to be in and out quickly if you trade large amounts. Because you can easily lose 20% in one day.

U.S Dollar is Plunging Fast!

Why is the Dollar and other currencies plunging?

In 2016 the U.S dollar was artificially depreciated with an agreement called the shanghai accord, between leaders of the G20 as there were a number of countries who could not pay back their debt and were at a risk of a sovereign debt crisis.

These countries including the USA agreed and so the US Dollar was devalued by around 15% to allow the countries to pay back their debts faster.

This was a coordinated move over a period of 14 months.

This most recent crash in the dollar has not been coordinated.

There was no agreement among the G20 leaders to devalue the Dollar.

The Dollar has devalued around 13% over the last 8 months,

Not only the Dollar but many other currencies have been devaluing.

The stimulus packages and quantitative easing between the USA and other countries globally has been the largest in history.

See the chart below showing 2016 and 2020 devaluation in the Dollar.

DXY – U.S. Dollar Index 10 Year Chart

U.S Dollar is Plunging Fast!

Confidence in the U.S Dollar is at an all time low. It has been decreasing over the last 10 years.

Why is the west losing confidence

- The printing of too much money.

- The political shenanigans ongoing since 2017 on both sides of the aisle.

- Investment in hard assets, wine, whisky, gold etc have seen consistent growth. Investors piling into Crypto currencies like Bitcoin indicate the populous does not have faith in a government run currency.

- Bad management of the covid-19 pandemic. Third world countries have handled the pandemic better than some modern western countries.

- Low confidence & trust in western media is at an all time low.

- Doubt and distrust in social media giants such as facebook, google and twitter due to their inconsistent policies, resulting in being accused of trying to control the narrative for their own benefit.

All of the above reasons have resulted in a world belief that the U.S is facing more than just a pandemic but a decline in western power.

This is irrelevant to which political party you belong to, but moreover about a world power shift from west to the east.

A good indicator that things are not going well for the economy is the US Treasury 10 year index.

The solution – Invest in hard assets such as fine wine and whisky, that will support your hedge against any downturn in the market. While giving you consistent growth.

See chart below showing a very unhealthy 10 year treasury index chart.

Why is confidence in western media at an all time low?

The speed at which we consume information has driven the media to publish more articles which has resulted in more unethical or false facts being published.

Promoting media in todays internet world, has driven sensational headlines to capture ‘clicks’ of the mass population. If you throw enough mud at the wall, it will eventually stick.

Making it harder for the public to know what is real and what is fake. The hardest part about reading todays news is deciphering what is genuine.

The latest gallup poll in September 2020

-

- 9% in U.S. trust mass media “a great deal” and 31% “a fair amount”

- 27% have “not very much” trust and 33% “none at all”

- The percentage with no trust at all is a record high, up five points since 2019

Small Business failings in 2020

In 2020, the number of small businesses in the US reached 31.7 million, making up nearly all (99.9 percent) US businesses.

There are currently 60.6 million small business employees in the US, which make up approximately half (47.1 percent) of the US workforce.

As of Aug. 31, some 163,735 businesses have indicated on Yelp that they have closed. That’s down from the 180,000 that closed at the very beginning of the pandemic. However, it actually shows a 23% increase in the number of closures since mid-July.

Are we heading into a deflationary spiral?

In June 2020, we wrote about the economy heading into a deflationary spiral. See here this is looking more realistic than ever going into 2021.

Pfizer on how the vaccine was developed

A recent publication of the head of research and the CEO of Pfizer to promote the vaccine they have produced was done by 60 minutes on Sunday The CEO of Pfizer stated they created the vaccine with an open check book. The goal being to create a safe vaccine at all costs in record time. It came at an eventual cost of $2 billion dollars.

The vaccine will likely end up selling around $14 billion worldwide in 2021 according to Damien Conover, the director of health care equity research at the firm Morningstar.